The North Carolina Senator added that protecting the Fed's independence from political interference or legal intimidation is non-negotiable.

- Warsh’s nomination to lead the central bank of the world’s largest economy drew mixed reactions from economists, experts, and senators.

- Mohamed El-Erian, Chief Economic Advisor at Allianz, said that Warsh’s nomination bodes well for the Fed’s independence, as well as the effectiveness of its policies.

- Senator Elizabeth Warren, who is a Ranking Member of the Senate Banking, Housing, and Urban Affairs Committee, voiced opposition to Warsh’s nomination.

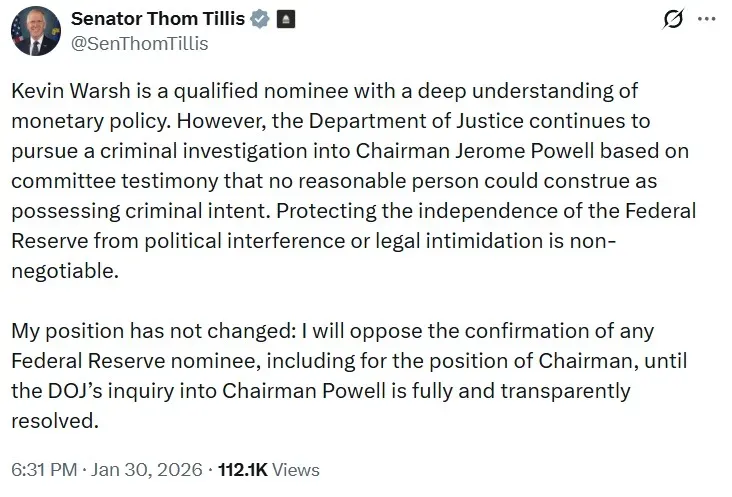

U.S. Senator Thom Tillis (R-N.C.) on Friday maintained that he will continue to oppose the nomination of President Donald Trump’s Federal Reserve Chair pick, Kevin Warsh, until an investigation into outgoing Fed Chair Jerome Powell is resolved.

“My position has not changed: I will oppose the confirmation of any Federal Reserve nominee, including for the position of Chairman, until the DOJ’s inquiry into Chairman Powell is fully and transparently resolved,” Tillis said in a post on X.

The North Carolina Senator added that protecting the Fed's independence from political interference or legal intimidation is non-negotiable.

Tillis is a member of the Senate Banking, Housing, and Urban Affairs Committee. His refusal to vote could lead to a potential stalemate, as the committee has 13 Republicans and 11 Democrats.

Reactions To Warsh’s Nomination

Warsh’s nomination to lead the central bank of the world’s largest economy drew mixed reactions from economists, experts, and senators.

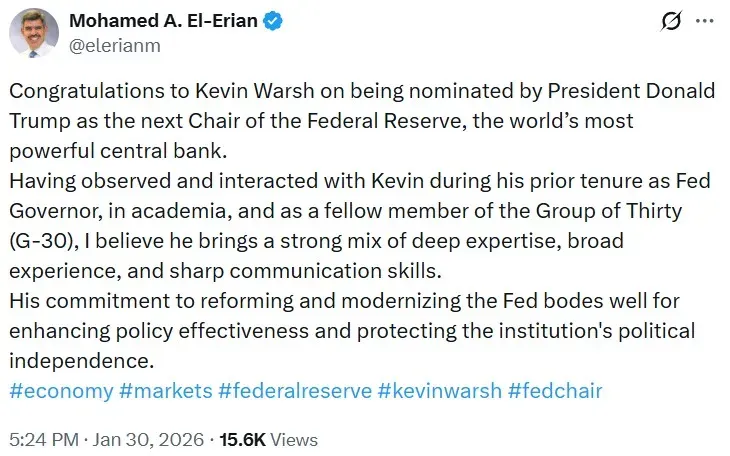

Mohamed El-Erian, Chief Economic Advisor at Allianz, said that Warsh’s nomination bodes well for the Fed’s independence, as well as the effectiveness of its policies.

“Having observed and interacted with Kevin during his prior tenure as Fed Governor, in academia, and as a fellow member of the Group of Thirty (G-30), I believe he brings a strong mix of deep expertise, broad experience, and sharp communication skills,” he said.

Senator Elizabeth Warren (D-Mass.), who is a Ranking Member of the Senate Banking, Housing, and Urban Affairs Committee, voiced opposition to Warsh’s nomination.

“This nomination is the latest step in Trump’s attempt to seize control of the Fed and follows the Trump Administration’s weaponization of the Department of Justice to open criminal investigations into Fed Governor Lisa Cook and sitting Fed Chair Jerome Powell,” she stated, while urging Republicans who care about the Fed’s independence not to agree with President Trump’s pick.

Robin Brooks, Senior Fellow at The Brookings Institution, called Warsh a “really good pick,” but voiced some skepticism about this decision’s impact on the U.S. dollar.

“Markets are asking themselves what was promised to get the nod, which is why the Dollar - after its huge decline in recent days - isn't managing to rally on what should be good news,” he said in a post on X.

What Is The DOJ Probe About?

At the heart of the DOJ’s criminal investigation into Fed Chair Powell is a $2.5 billion renovation of the Fed’s Eccles Building.

In July 2025, Rep. Anna Paulina Luna announced that she had referred Powell to the DOJ for potential perjury connected to his testimony about the Fed headquarters renovation project.

Reacting to the probe, Powell warned that its outcome would determine whether the central bank could set monetary policy going forward, or whether it would instead be directed by political pressure or intimidation.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President,” he said.

Meanwhile, U.S. equities declined in Friday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.28%, the Invesco QQQ Trust ETF (QQQ) fell 0.57%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.13%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was down by 0.34% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) fell 0.04%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<