The downgrades follow ongoing challenges for several Chinese retailers navigating softening consumer demand and market uncertainty.

Retail investors appeared strongly bullish about the prospects of Temu parent PDD Holdings (PDD) on Friday, even as the e-commerce company got several Wall Street downgrades following worse-than-expected fourth-quarter revenue and “uncertainty” in its overseas operations.

Analyst firm Nomura downgraded PDD to ‘Neutral’ from ‘Buy,’ cutting its price target to $130, from $137, U.S. Tiger analyst Bo Pei also downgraded PDD to ‘Hold’ from ‘Buy’ with an unchanged price target of $130, while BofA analyst Joyce Ju lowered the firm's price target to $140 from $142 with a Neutral rating.

The downgrades follow ongoing challenges for several Chinese retailers navigating softening consumer demand and market uncertainty.

Nomura noted Temu's “remodeling” of its U.S. market operations, The Fly reported citing the analyst. Pei of Tiger said the combination of slowing growth and rising investments created "near-term uncertainty."

PDD’s Q4 revenue grew 24% year-over-year, slowing down from 44% in the third quarter, coming in at 110.31 billion yuan below the consensus of 115.77 billion yuan, according to Fly. Earnings per share stood at 20.15 yuan, above the estimated 19.67 yuan.

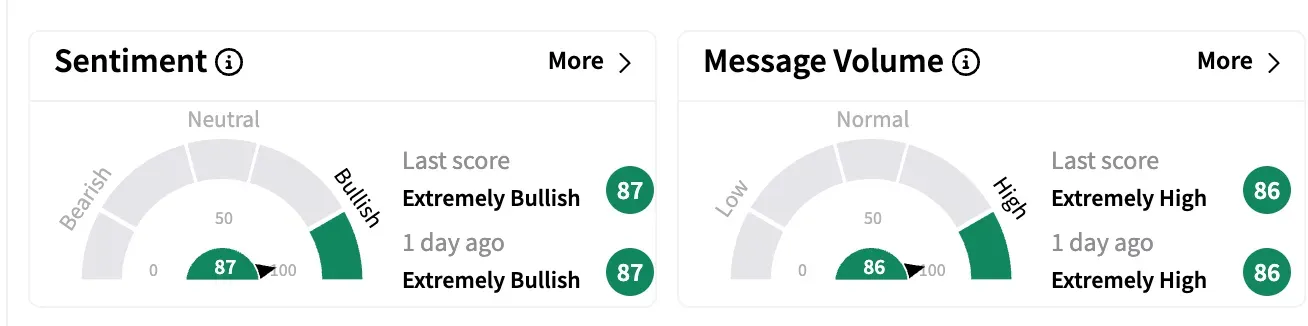

Sentiment on Stocktwits ended on an ‘extremely bullish’ note on Friday. Message volume continued to be ‘extremely high.’

One bullish watcher noted how the company’s stock trajectory is setting up well for the long run.

Following its fourth-quarter results, PDD’s management also spoke about boosting its investments to strengthen consumer experiences, platform ecosystem and merchant support.

"Leveraging our digital capabilities, we continued to give back to consumers and support quality merchants, building an inclusive ecosystem that creates value for all participants,” said Jiazhen Zhao, co-CEO.

Temu was reportedly in regulatory crosshairs earlier this year after reports emerged that the U.S. was considering adding Chinese retailers Temu and Shein on the Department of Homeland Security's "forced labor" list. Both companies denied the use of forced labor.

PDD stock is up 30% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<