Several Wall Street firms moved quickly to reset expectations, citing limited upside now that the stock trades close to the proposed buyout price.

- Daniel Jester of BMO Capital downgraded the stock to ‘Market Perform’ from ‘Outperform’, citing the low likelihood of a competing offer emerging.

- Wolfe Research said the shares now offer little remaining upside.

- Morgan Stanley also downgraded the stock to ‘Equal Weight’ and described Hg Capital’s proposal as reasonable.

OneStream Inc. (OS) drew a wave of analyst downgrades following its agreement to be taken private by Hg Capital in an all-cash deal that values the financial software company at about $6.4 billion.

Several Wall Street firms moved quickly to reset expectations, citing limited upside now that the stock trades close to the proposed buyout price.

Multiple Firms Reassess Valuation

Daniel Jester of BMO Capital downgraded the stock to ‘Market Perform’ from ‘Outperform’ and trimmed his price target to $24 per share from $25, according to TheFly. The analyst said the downgrade reflects the agreed acquisition price and the low likelihood of a competing offer emerging.

Wolfe Research echoed that view, cutting OneStream to ‘Peer Perform’ from ‘Outperform.’ The firm said the shares now offer little remaining upside since they trade near the deal price.

Morgan Stanley also downgraded the stock to ‘Equal Weight’ from ‘Overweight’ while cutting its price target to $24 from $27. The firm described Hg Capital’s proposal as reasonable and said it expects the transaction to clear regulatory hurdles.

The firm highlighted BlackLine Inc. (BL) as a potential beneficiary of the transaction, suggesting the buyout may be positive for comparable software assets. OneStream stock inched 0.1% lower in Wednesday’s premarket.

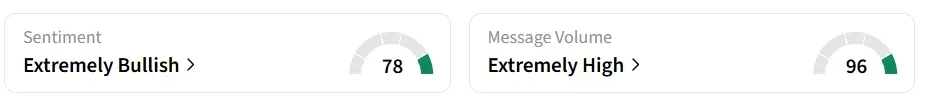

On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hour.

Mizuho Questions Chances Of A Bidding War

Mizuho analyst Siti Panigrahi downgraded OneStream to ‘Neutral’ from ‘Outperform’ and trimmed the firm’s price target to $24. The firm said it does not expect a higher bid, noting that the agreed valuation aligns with recent software take-private transactions.

OneStream’s acquisition agreement will take the company off public markets, reshaping its ownership structure. Under the terms of the deal, holders of OneStream stock will receive $24.00 per share in cash for their positions, a 31% premium to the stock’s closing price on January 5.

Hg will become the majority voting stakeholder, and OneStream is expected to benefit from expanded resources to accelerate its artificial intelligence-driven offerings for corporate finance teams.

OS stock has declined by over 13% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<