The deal aligns with Nvidia’s broader push into synthetic data generation, seen at GTC 2025, which helps developers train AI models with highly customized datasets.

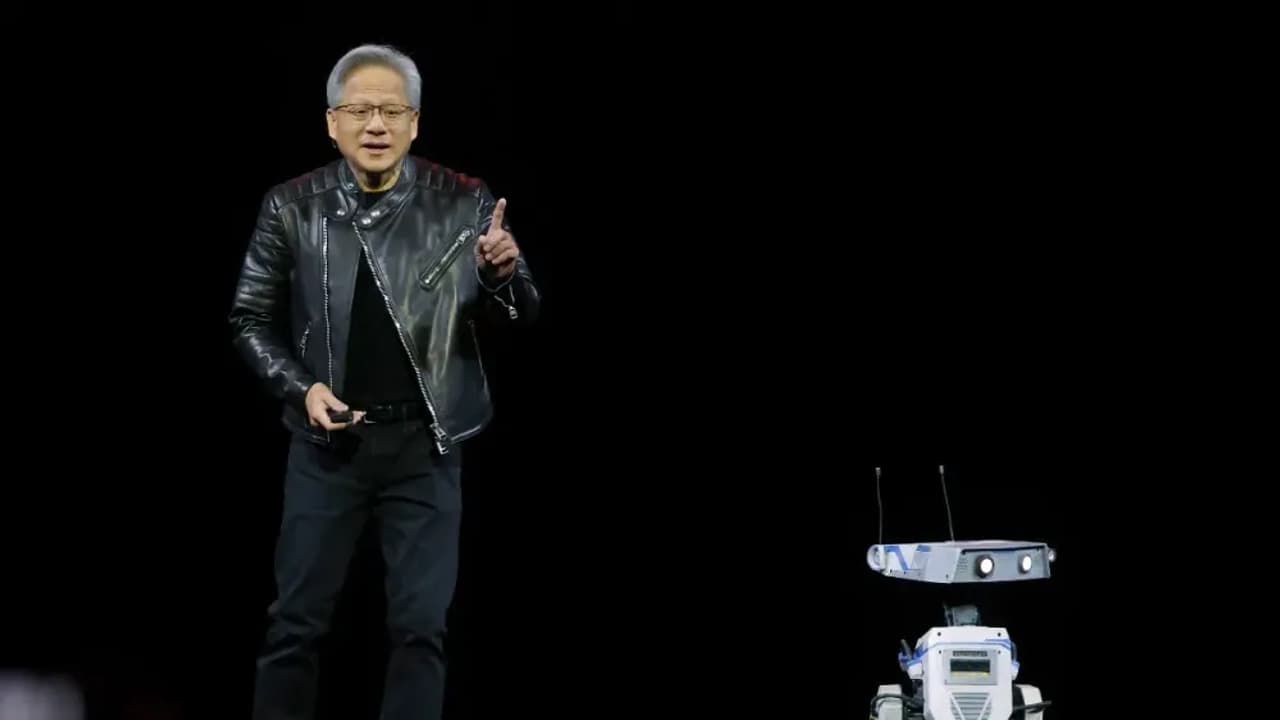

Nvidia (NVDA) shares climbed over 2% on Wednesday following CEO Jensen Huang’s GTC 2025 keynote, where he unveiled new AI-driven initiatives. Meanwhile, reports surfaced that Nvidia has acquired synthetic data company Gretel in a nine-figure deal.

According to a report by Wired, the acquisition price exceeds Gretel’s last known valuation of $320 million, though specific financial terms remain undisclosed.

Sources familiar with the matter said that Gretel’s team of about 80 employees will integrate into Nvidia, contributing to the company’s expanding suite of cloud-based generative AI tools for developers.

Nvidia, thus far, has declined to comment on the reported acquisition.

The deal aligns with Nvidia’s broader push into synthetic data generation, which helps developers train AI models with highly customized datasets.

One of Huang’s keynote highlights was the launch of the Isaac GR00T Blueprint, a framework designed to streamline the creation of synthetic motion datasets for humanoid robots. This tool employs imitation learning, allowing robots to acquire new skills by mimicking human behavior.

Additionally, Nvidia introduced a major update to its Cosmos world foundation models (WFMs), enabling developers to build highly adaptable AI models for physical simulations.

The company also rolled out two new blueprints powered by its Omniverse and Cosmos platforms, designed to generate massive synthetic datasets for training autonomous vehicles and robots.

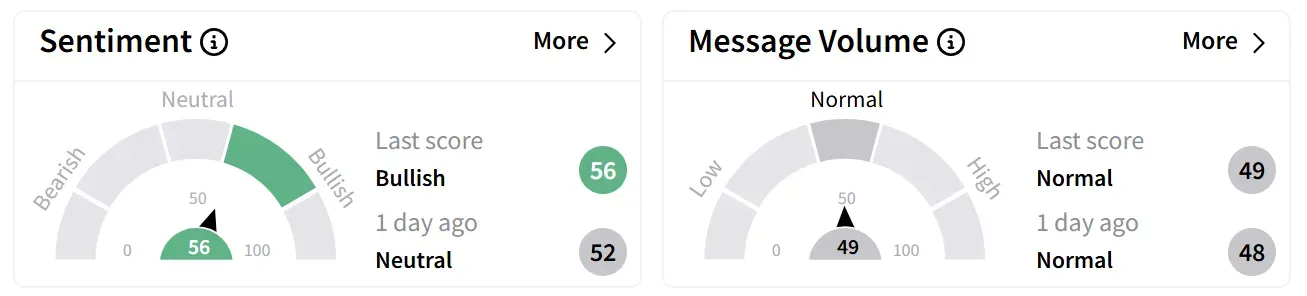

On Stocktwits, retail sentiment around Nvidia’s stock improved to ‘bullish’ from ‘neutral’ a day ago.

One trader pointed to a bullish double cup formation, a technical indicator suggesting upward momentum.

However, some remain cautious, citing potential downside risks from tariffs expected to take effect on April 2 under U.S. President Donald Trump’s trade policies.

Nvidia’s stock has gained 35% over the past year but remains down 13% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Nvidia Stock Climbs Pre-Market After Jensen Huang’s GTC 2025 Keynote – Wall Street, Retail Bullish On AI Roadmap