LPL Chief Technical Strategist Adam Turnquist said stretched valuations and concerns over the return on investment from significant spending on AI have weighed on the mega-cap space.

The tech-heavy Nasdaq Composite Index traded in correction territory on Thursday as industry-specific and macroeconomic concerns sapped traders' risk appetite. The market has been on a lackluster trajectory since February as investors question whether the bull market that began in October 2022 has run its course.

The index was down 2.44% at 18,100.78, marking a 10.4% pullback from its Dec. 16 intraday high of 20,204.58. A close below the 18,184.122 level will place the index firmly in correction territory.

The Nasdaq 100 Index, which comprises 100 of the biggest non-financial tech stocks, held just above the correction zone.

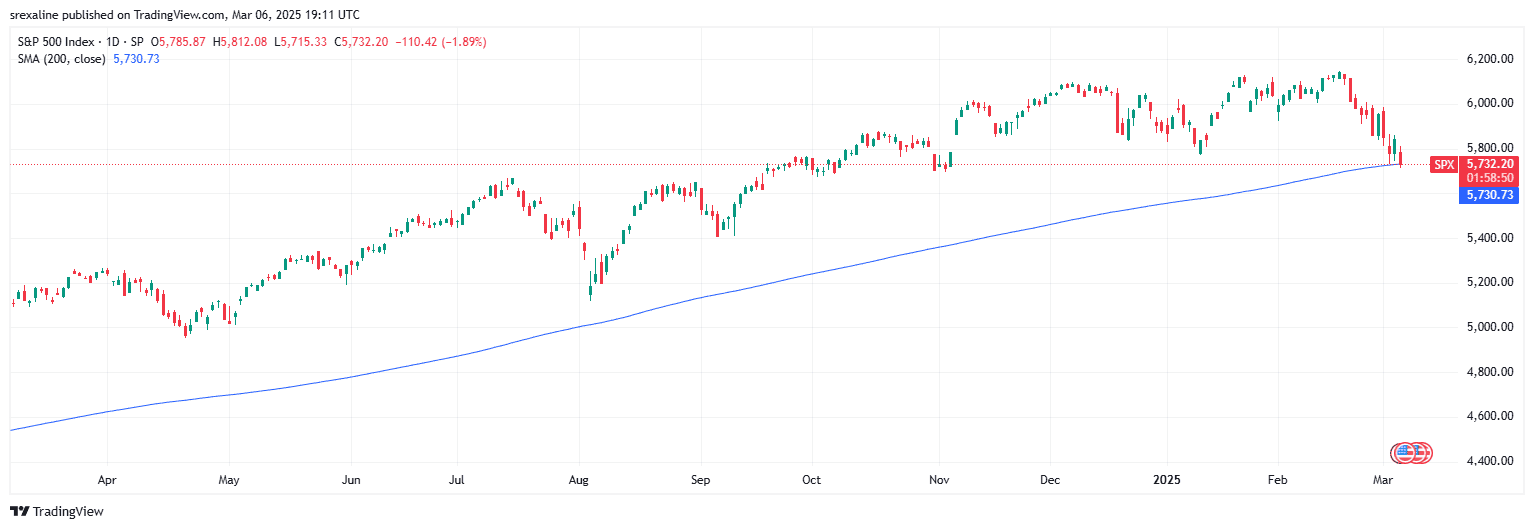

The broader S&P 500 Index fell to a five-month low and has broken below its 200-day simple moving average (SMA). Several analysts say this technical development suggests the sell-off could worsen if buyers don’t step in at this key level.

Thursday’s weakness is a function of a host of factors, including:

- Negative earnings from artificial intelligence (AI)-levered chipmaker Marvell Technology, Inc. (MRVL) and a few other tech companies

- Chinese threat to the dominance of U.S. tech names, especially in the AI arena

- Fears concerning the fallout from President Donald Trump’s tariffs, including a potential recession

Trump’s concession of granting a month’s exemption to automakers that comply with the U.S.-Mexico-Canada (USMCA) trade agreement and for those Mexican ports that adhere to the agreement did little to lift the market mood.

Even as the market recovered from the dent created by Chinese AI startup DeepSeek, Alibaba Group Holding Limited (BABA) inflicted further wounds by announcing its latest AI reasoning model. The company said the new model, named QwQ-32B, showed exceptional performance, exceeding the performance of OpenAI’s 01-mini and the DeepSeek-R1 model.

This set off a sell-off in the tech companies heavily invested in AI technology, including Nvidia Corp. (NVDA).

Delving into the recent tech weakness, LPL Chief Technical Strategist Adam Turnquist said stretched valuations and concerns over the return on investment from significant spending on AI have weighed on the mega-cap space. “The transition of many of these companies from asset-light to asset-heavy businesses can complicate the earnings growth outlook,” the strategist said.

Morgan Stanley economists expect a meaningful impact if tariffs are fully implemented. They expect U.S. inflation to tick up by 0.3 to 0.6 percentage points over the next three to four months and GDP growth to fall by 0.7-1.1 percentage points from the baseline scenario.

Among the sectors red-flagged by the firm were hardware and equipment, autos, and consumer subsets.

Fund manager Louis Navellier, however, sees light at the end of the tunnel. The plunge in bond yields due to Trump’s policies could force the Federal Reserve to lower the Fed funds target rate.

“The combination of strong forecasted earnings with more Fed key interest rate cuts is effectively a ‘one-two punch’ that should propel our fundamentally superior stocks substantially higher,” he said.

On Thursday, the European Central Bank delivered its sixth rate cut in the current monetary policy cycle, citing an unfolding global trade war and the move toward increased military spending in the region.

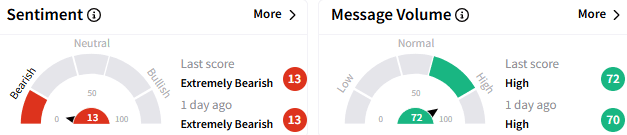

Retail traders' sentiment on the Stocktwits platform remained ‘extremely bearish’ (13/100) toward the Invesco QQQ Trust (QQQ), an exchange-traded fund that tracks the Nasdaq 100 Index.

The QQQ ETF last traded down 2.70% at $488.45.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<