According to Chairman and CEO David Bailey, bringing both companies under the helm of Nakamoto was part of the company’s vision “since day one.”

- Nakamoto’s shares rose as much as 7.35% in overnight trade after announcing an all-stock acquisition of BTC Inc. and UTXO Management.

- Nakamoto will issue 363.56 million shares, valued at roughly $107.3 million at current pricing.

- According to CEO David Bailey, the company acquired BTC Inc. at a 70% discount.

Shares of Nakamoto Inc. (NAKA) led gains among crypto-linked equities Tuesday night after the company announced an all-stock deal to acquire BTC Inc. and UTXO Management, consolidating three Bitcoin-focused businesses under one corporate umbrella.

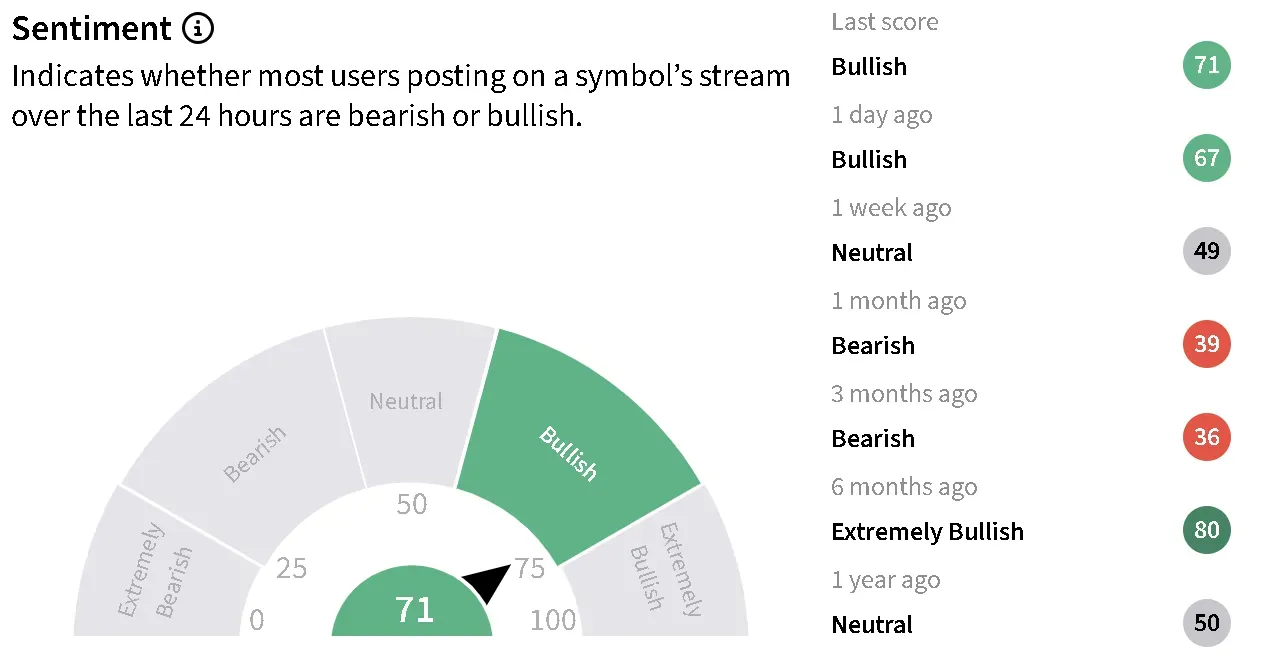

NAKA’s stock rose as much as 7.35% in overnight trading, with retail sentiment on Stocktwits becoming even more ‘bullish’ over the past day.

This Was Nakamoto’s Plan Since ‘Day One’

According to Chairman and CEO David Bailey, bringing both companies under the helm of Nakamoto was part of the company’s vision “since day one.” He said Nakamoto intends to invest in companies that can scale with Bitcoin’s (BTC) long-term growth. “This transaction signifies the first step of the company we intend to build, and we’re just getting started,” Bailey stated.

Bailey also leads BTC Inc., placing him at the center of all three entities involved in the transaction. As a result, the acquisition qualifies as a related-party deal. Nakamoto said a special committee of independent directors approved the transaction with input from outside legal and financial advisers.

Nakamoto Buys BTC Inc At 70% Discount

BTC Inc is a media and events company and the parent company behind Bitcoin Magazine. Meanwhile, UTXO is an investment firm focused on private and public Bitcoin (BTC) companies. NAKA said it would issue 363.56 million shares, valued at approximately $107.3 million, to fund the purchase. The deal is expected to close in the first quarter of 2026.

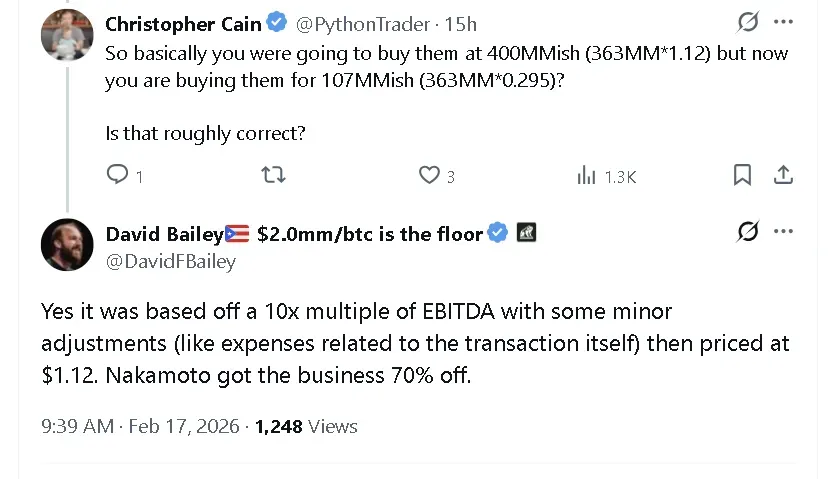

One user on X noted that the agreed share price of $1.12 would have implied a valuation exceeding $400 million at the time the deal was initially structured. With NAKA now trading below $0.30, the effective value of the acquisition has fallen to about $107 million. “Nakamoto just got the business 70% off,” said Bailey, confirming that the math was accurate.

Retail Concerns Linger

One Stocktwits user stated the stock remains “safe” unless Bitcoin falls toward $49,000, while warning that short sellers could continue to pressure shares.

Another user criticized the deal structure, arguing that Bailey would benefit disproportionately by folding his own companies into the public entity.

Nakamoto, formerly known as KindlyMD, pivoted to a Bitcoin treasury in 2025. The company currently holds 5,398 BTC, valued at approximately $365.76 million at Bitcoin’s current price, placing it among the top 20 public companies with BTC in their holdings.

Bitcoin’s price was trading at around $67,700 on Friday night, down 1% in the last 24 hours. Retail sentiment around the apex cryptocurrency on Stocktwits trended in ‘bearish’ territory over the past day. Bitcoin’s price has slumped around 22% this year and fallen more than 46% from its record high of more than $126,000 in October.

Meanwhile, NAKA’s stock is down more than 25% this year and has fallen more than 76% since Bitcoin’s record high.

Read also: Dogecoin, Ethereum Outpace Bitcoin While Crypto Market Slips Below $2.4 Trillion

For updates and corrections, email newsroom[at]stocktwits[dot]com.<