The record high comes as investors reassess Micron’s positioning in the AI-driven memory market.

- Shares extended gains after Micron posted record quarterly revenue and sharply higher year-on-year growth.

- Micron flagged tight supply conditions and continued strength in AI-driven memory demand.

- The company guided for further margin expansion as pricing, product mix, and long-term customer agreements improve.

Shares of Micron Technology (MU) hit a record high ahead of the Christmas holiday, capping a rally that has made the company the best-performing chipmaker in the S&P 500 this year.

At the time of writing, the stock rose 4% to $286.94.

Futurum Equities said in a post on X that the move signals that investors are beginning to reprice Micron away from a mid-cycle Dynamic Random Access Memory (DRAM) trade and toward a “strategic AI supplier” with higher and more durable margin floors.

AI-Driven Revenue Acceleration

Micron reported record revenue of $13.64 billion for the first quarter of fiscal 2026, which ended Nov. 27, representing year-on-year growth of 57%. While the quarterly revenue base remains smaller than that of peers such as Broadcom and Oracle, Micron’s growth rate outpaced both companies over the same period.

CEO Sanjay Mehrotra said that the company benefited from strong execution across end markets and a tight supply environment, delivering record performance across DRAM, NOT AND (NAND), high-bandwidth memory and data center revenue. He said demand reflects a structural shift in the memory market as AI workloads increasingly rely on advanced memory.

Margins And Pricing Outlook

Margins have expanded alongside revenue growth. DRAM accounted for 69% of first-quarter sales, and CFO Mark Murphy said gross margin is expected to continue rising in the second quarter, supported by higher prices, lower costs and a favourable mix. Micron guided to a gross margin of about 68%, plus or minus 100 basis points.

In an earnings review, Baird analyst Tristan Gerra said he expects DRAM and NAND pricing to rise about 20% sequentially as Micron works toward long-term supply agreements with customers and that shortages are likely to persist through next year.

Visibility And Supply Constraints

Micron said on the earnings call that tight market conditions, driven by strong demand and supply constraints, are expected to persist beyond calendar 2026. Executive vice president of operations Manish Bhatia said the company is already sold out of its high-bandwidth memory capacity for 2026.

PC makers such as Dell Technologies and HP have warned of memory shortages in the coming year, contributing to higher component prices.

How Did Stocktwits Users React?

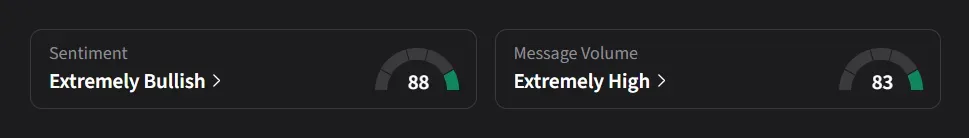

On Stocktwits, retail sentiment for Micron was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said Micron shares were about 3% away from trading in the 300s for the first time, adding that the stock was “still trading at the same valuation as low 100s.. that’s how monster of an earnings it had”

Another user said the stock had moved past the $286 level, adding that a move toward $295 this week would be a bonus, while maintaining a longer-term positive view.

Micron’s stock has risen 4% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<