Tata Consumer, LTIMindtree, and Nestle India have reported their Q4 earnings, prompting mixed market reactions. SEBI-registered analysts weigh in on what technical indicators suggest for each stock’s next move.

As the Indian Q4 earnings season heats up, Tata Consumers, LTI Mindtree and Nestle India have drawn significant attention with their results. The market reaction has been mixed, with investors parsing headline numbers, margin shifts, and management commentary.

Here’s what SEBI-registered analysts are making of their stock moves going forward.

- Tata Consumers

Tata Consumer’s shares gained nearly 2% after it posted a 59% rise in net profits at 344.85 crore. Margins on the other hand contracted to 13.5%, impacted by higher tea costs.

However, data on Stocktwits India shows that retail sentiment turned ‘bearish’ from ‘neutral’ a week ago.

SEBI-registered analyst Anupam Bajpai shared key levels to watch on Stocktwits post the earnings.

Bajpai points out that the stock's Relative Strength Index (RSI) has dropped to 70 from 78, adding that overbought conditions may signal a near-term correction.

He recommends a wait-and-watch approach, advising investors to look for a clear breakout above ₹1,156 for bullish confirmation. Adding that a breach of support could trigger a decline toward the 200-day EMA, which would serve as a crucial support.

Tata Consumer stock has gained 26% year-to-date (YTD)

- LTI Mindtree

LTIMindtree’s share price declined nearly 2% after its fourth-quarter earnings report despite an increase in net profit to ₹1,128 crore. Additionally, the board proposed a final dividend of Rs 45 per share.

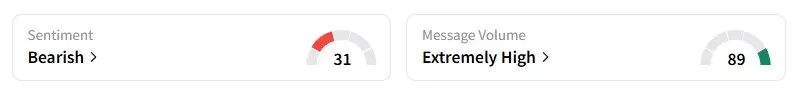

Data on Stocktwits India shows that retail sentiment turned ‘bearish’ a day ago with extremely high message volumes.

SEBI analyst Bajpai notes that a decisive close above ₹4,680 could signal further upside potential, with the next key hurdle being the 50-day exponential moving average, which is likely to act as a crucial resistance.

Until then, he advised investors to wait for a confirmed breakout above ₹4,680 before considering fresh positions.

LTI Mindtree stock has lost 20% year-to-date (YTD).

- Nestle India

Nestle India's shares dropped 1% following the release of their fourth-quarter earnings, which showed a 5.2% decrease in net profit to ₹885 crore due to increased raw material costs.

Despite this, revenue rose by 4.5% to ₹5,504 crore, with margins decreasing to 23.6%. The beverages and confectionery segments experienced double-digit growth, while the milk and nutrition segments remained stable.

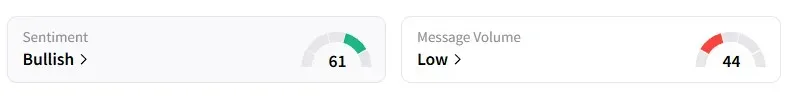

Data on Stocktwits India shows that retail sentiment remains ‘bullish.’

SEBI-registered analyst Financial Independence highlights that if Nestle breaks the support level of ₹2,390, it can see next support at ₹2,200-2300.

Nestle India stock has gained 11% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.