SEBI analyst highlights that Marico’s Q4 results reinforce its growth trajectory, and the technical setup suggests further upside potential for the stock.

Marico is gaining investor attention after reporting its strongest revenue in 14 quarters, with the stock rising over 4% post-earnings and now hovering near its all-time high of ₹735.

SEBI-registered analyst Sanyam Vaish believes this rally is backed by both solid fundamentals and strong technical signals, setting the stage for a potential breakout.

The FMCG major reported a 20% year-on-year increase to ₹2,730 crore, while profit after tax rose 8% to ₹343 crore despite raw material inflation pressures.

The India business saw robust performance, with volumes up 7% and revenues up 23%, and the international segment also posted impressive growth, particularly in the MENA region (+47%) and Bangladesh (+11%).

Marico’s Foods and Premium Personal Care categories — featuring brands like Saffola Oats, Beardo, Just Herbs, and Plix — are now contributing ₹2,000 crore on an annualised run rate, reflecting the success of its premiumisation strategy.

On the technical front, Marico’s share price is trading near ₹726, close to its all-time high of ₹735, supported by a surge in trading volumes and healthy momentum.

Vaish highlights that all major simple moving averages (SMAs) are bullishly aligned, with the 20-day SMA at ₹712 and the 200-day SMA at ₹655 acting as key support levels.

The relative strength index (RSI) is at 65, indicating strong but not overbought momentum, and volume trends confirm bullish sentiment.

He views this as a “classic case of FMCG rerating,” driven by strong results and a “premiumisation” strategy.

As long as the ₹712 support holds, he expects the stock to break above ₹735 and target new highs, with any pullbacks seen as buying opportunities.

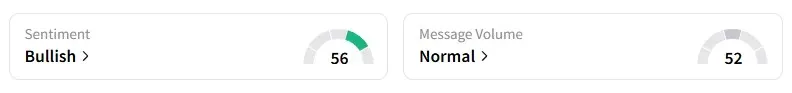

Data on Stocktwits shows that retail sentiment remains ‘bullish’ on this counter.

Marico shares have gained 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<