The stock hit a record high on Wednesday, helped by positive commentary from top analysts and strong revenue expectations for the current quarter.

- Following the relentless surge in the company’s stock price, its market cap has crossed $27 billion.

- Analysts at Morgan Stanley have raised their price target on the stock by 60% to $304 from $190.

- Lumentum’s CEO has said the company’s broad optical portfolio is well-positioned to support the rapid expansion of AI compute.

Shares of Lumentum Holdings (LITE) hit a record high on Wednesday, riding a wave of strong analyst commentary and robust excitement around artificial intelligence and cloud data centers, which have boosted demand for its products.

Shares of Lumentum have more than quadrupled this year and are on track for their eighth-straight monthly gains. The surge has lifted the company’s market cap beyond $27 billion.

What Is Making Analysts Optimistic?

AI-fueled data center expansions, as well as increased demand for cloud and enterprise services, have driven up interest in firms that design and manufacture optical and other high-performance components crucial to cloud data centers and telecom networks.

Analysts at several top brokerages have raised their price targets on Lumentum, citing strong momentum in the optical fiber space amid rising global adoption of artificial intelligence. Morgan Stanley raised its price target on the stock by 60% to $304 from $190.

Bank of America analysts said it “significantly” raised its price target on Lumentum to $375 from $210 due to outsized demand for optical transceivers and components, which continue to exceed supply, as per TheFly.

Management’s Confidence

Lumentum’s top executive, Michael E. Hurlston, said during an earnings call with analysts last month that 60% of the company’s sales are now coming from cloud and AI infrastructure. Further, adding that the company’s growth is powered by AI demand for Lumentum’s laser chips and optical transceivers in data centers.

He said that the company’s broad optical portfolio is well-positioned to support the rapid expansion of AI compute.

The company saw sales for its first quarter (Q1) ended September 27 of its fiscal year 2026 surge 58.4% to $533.8 million, beating analyst estimates of $526 million, according to Fiscal.ai data. It also expects revenue for its second quarter of fiscal year 2026 to be in the range of $630 million to $670 million, with the higher end well above the analyst estimates of $646.7 million.

How Did Stocktwits Users React?

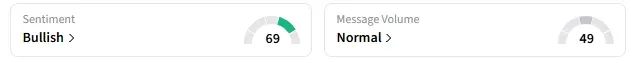

Retail sentiment around LITE trended in “bullish” territory amid “normal” message volume.

One bullish user expects Lumentum to be among the ‘winners’ in 2026.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<