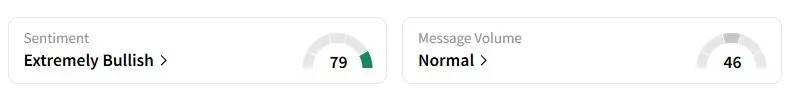

Data on Stocktwits shows that retail sentiment on the stock has turned 'extremely bullish' from 'neutral' a month ago.

India's largest insurer, Life Insurance Corporation, is gaining attention, with its stock rising nearly 7% in the past week.

A new research note shared by SEBI-registered Finlight Research on Stocktwits India points to a compelling story brewing around fundamentals and its strategic transformation.

Data on Stocktwits also shows that the retail sentiment on the stock has turned 'extremely bullish' from 'neutral' a month ago.

In recent developments, the government-owned insurer has enhanced its digital push with improved policy issuance, renewals, and customer service platforms.

It's also striking fintech partnerships to offer more innovative solutions tailored to digital-native audiences. Investors will be watching for management commentary and cues from its fourth-quarter earnings that are due in May.

Finlight Research highlights that the stock is showing early signs of a bullish reversal, rebounding from a strong ascending trendline support that has held firm since mid-2023. A breakout above a key white trendline points to a potential upside of nearly 23% over the longer term.

The analyst noted that the price is now attempting to sustain above the 20-day simple moving average (SMA) while the Relative Strength Index (RSI) hovers in the 40–50 range.

That suggests the stock may be emerging from a bearish zone, though it's not yet overbought, according to Finlight.

Further strengthening the case for a turnaround, another technical indicator (MACD) has shown a bullish crossover, signaling the beginning of potential upward momentum.

Finlight pegs LIC's price target at ₹870 to ₹980 in the near to medium term, with the potential to surpass ₹1,100 over the long term; they keep the stop loss at ₹750.

The analyst believes the stock has a 20%–25% potential upside if the trend reversal sustains.

LIC stock is down 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<