The stock is trading near multi-month highs, and a recent breakout signals room for further gains, according to the analyst.

Lemon Tree Hotels has recently seen a strong technical breakout, supported by high volume and sectoral tailwinds, according to SEBI-registered analyst Vijay Kumar Gupta.

The stock is trading near multi-month highs, with price action firmly above the Ichimoku cloud, reiterating the bullish trend. Recent candles indicate healthy consolidation following the breakout.

Elevated Commodity Channel Index (CCI) levels of around 139, along with a green Trailing Twelve Months (TTM) Squeeze, indicate momentum and trend expansion, as shown by rising histogram bars. Additionally, positive CMF indicates steady money inflow, Gupta said.

Fundamentally, Lemon Tree continues to benefit from a revival in domestic travel and business tourism.

Lemon Tree is India’s largest mid-priced hotel chain with over 8,600 rooms across more than 50 cities. Its operational occupancy has crossed 80% in metro markets, while premium offerings under the ‘Aurika’ and ‘Lemon Tree Premier’ brands have strengthened its value proposition.

The company has posted solid financial results in the past. In Q4FY25, Lemon Tree reported a 20% increase in revenue to ₹254 crore, with an EBITDA margin of 48%, while net profit nearly doubled to ₹39 crore.

The company has been on an expansion spree and recently launched new properties in Banswara, Rajasthan and Erode in Tamil Nadu.

With improving revenue per available room (RevPAR), debt reduction, and an aggressive asset-light expansion strategy in Tier 2 and 3 towns, investor sentiment around the company remains upbeat.

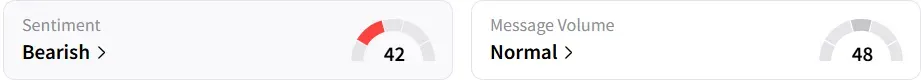

Despite the upbeat indicators, retail sentiment on Stocktwits remained ‘bearish’, possibly due to profit booking after gaining more than 16% over the past month.

At the time of writing, Lemon Tree shares were down 1% at ₹156.3

Year-to-date, the shares have climbed a little over 2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<