The company reported an 86% jump in Q1 profits. Fundamentals remain strong, aided by institutional inflows and monsoons.

Chemicals and fertilizers company Krishana Phoschem reported a staggering 86% surge in its June quarter (Q1FY26) net profit, while total income also saw a healthy 41% growth but fell 16% sequentially.

Despite the positive results, Krishana Phoschem shares were down 2.8% to ₹480.

From a technical perspective, the stock is showing renewed strength, suggesting a resumption of its bullish trend after a healthy retracement, said SEBI-registered analyst Vijay Kumar Gupta.

The daily chart structure has flipped bullish since April, confirmed by a change of character (CHoCH) and a strong alignment on the Ichimoku setup, with price holding above the Tenkan, Kijun, and cloud levels, Gupta noted.

The future cloud remains green and rising, indicating sustained upward momentum. A fair value gap (FVG) demand zone between ₹300 and ₹320 has provided support, with recent price action bouncing strongly.

Momentum indicators are also turning favorable. The commodity channel index (CCI) has climbed back above the 33.91 level, signaling a return of buying strength, while the on-balance volume (OBV) continues to rise, reflecting increased participation from smart money.

The immediate resistance lies in the ₹510 - ₹525 zone, and a breakout above these levels could lead to the stock climbing to the ₹600 - ₹630 range in the coming weeks, he added.

Fundamental tailwinds are also supporting sentiment, Gupta noted. Agri and fertilizer stocks are gaining investor interest as monsoon spreads across the country. Krishana Phoschem, with its phosphate exposure and capacity expansion roadmap, is well-positioned to benefit.

Additionally, the broader trend of institutional inflows into mid-cap specialty chemical and agri-related stocks adds to the bullish case.

Overall, the trend remains positive with support between ₹445 and ₹470, Gupta said, recommending taking up new positions during dips near ₹470.

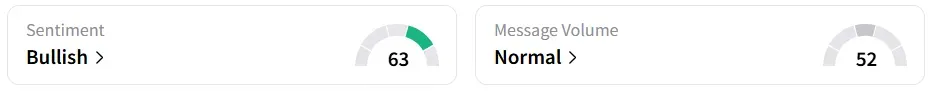

Retail sentiment on Stocktwits was ‘bullish’.

Year-to-date, the stock has increased in value by nearly 140%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<