The Swedish fintech firm swung to a net loss of $26 million in the last quarter, driven by higher provisions, versus a $40 million net profit a year ago.

- Klarna stock saw its steepest single-day drop since the company went public last September.

- The company’s Q1 revenue and GMV forecasts were below analysts’ expectations.

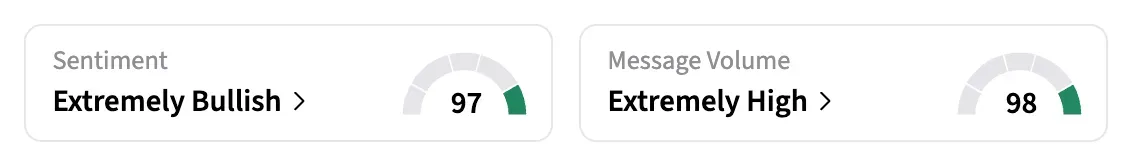

- Stocktwits sentiment flipped to ‘extremely bullish’ from ‘neutral.’

Klarna Group Plc shares plummeted by more than 26% on Thursday before recovering slightly in the after-market session, after the company reported a fourth-quarter net loss and issued a weak forecast for the current quarter.

The drop was the steepest since the Swedish buy-now-pay-later (BNPL) firm listed its shares on the New York Stock Exchange last September. Shares rose 0.1% to $13.87 in post-market trading, still firmly below the IPO price of $40 from Sept. 10.

Klarna Outlook Misses Wall Street’s Targets

Klarna expects first-quarter revenues to be between $900 million and $980 million, the midpoint of which is below Wall Street’s target of $965.1 million.

Gross merchandise value (the value of all goods and services sold on the platform) is estimated at $32 billion to $33 billion, below the consensus estimate of $33.37 billion.

Klarna Q4 Results

In the fourth quarter, the company posted a net loss of $26 million, compared with a $40 million net profit in the corresponding quarter a year ago. Analysts were expecting a net loss of $8.8 million. The bottom line was partly weighed by the provisions for credit losses, which increased 60% to $250 million.

Revenue rose 38% to $1.08 billion, inching past the $1 billion figure for the first time and topping the $1.07 billion estimate.

CEO Sebastian Siemiatkowski told Reuters that Klarna’s rapid growth weighed on results, as costs were booked up front while the revenue and profit would come later.

What Wall Street, Retail Traders Think About KLAR

Following the report, Wedbush slashed its price target on KLAR stock to $20 from $45, while maintaining its ‘Outperform’ rating.

On Stocktwits, retail sentiment for KLAR flipped to ‘extremely bullish’ as of late Thursday, from ‘neutral’ the previous day.

"Thank you to all the scary people in the room. It still amazes me when people will [love] buying a stock at $20, but hate buying it at $13," posted one bullish user.

"This is a discount and not a failure. I love klarna," said another.

However, there was plenty of skepticism too. "I guess the question is: what happens when people can't even 'pay later'?" wrote one watcher.

Klarna’s results, which showed robust revenue growth at the expense of wide losses, sparked debate on the platform, with many calling the significant share price drop an overreaction to underlying growth, while others condemned the BNPL model as unsustainable amid rising credit risks.

Klarna's stock is down 65% since its IPO last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<