Retail sentiment remains ‘bearish’ on Stocktwits; investors weigh Q1 results and US-India trade signals.

Indian equity markets ended flat after a range-bound session on Wednesday, with the Nifty index holding the 25,200 level. Caution prevailed on Dalal Street due to the ongoing earnings season and anticipated developments in the US-India trade deal, which faces an August 1 deadline.

On Wednesday, the Sensex closed 63 points higher at 82,634, while the Nifty 50 ended 16 points higher at 25,212. Broader markets reflected similar moves, with the Midcap index rising 0.7% and the Smallcap indices ending flat.

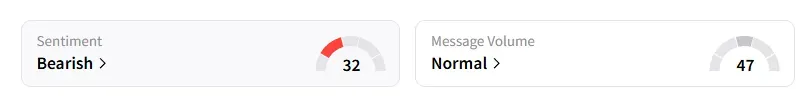

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ on Stocktwits.

Sectorally, PSU banks were the largest gainers (+1.8%), followed by the media (+1.3%) and IT (+0.6%). On the other hand, metals and pharmaceutical stocks witnessed selling pressure.

M&M was the top Nifty gainer (+2%), followed by Wipro and Tech Mahindra, which ended higher ahead of its first quarter (Q1) earnings.

SBI shares rose nearly 2% after its board approved funds up to ₹20,000 crore viathe issue of bonds in the current fiscal year.

ITC Hotels surged 5% after reporting strong Q1 earnings. Network18 shares rose 11% on a robust show in Q1. On the flip side, ICICI Prudential and ICICI Lombard fell over 2% as the street parsed its earnings.

Bicoon ended over 1% after its subsidiary received approval from the U.S. Food and Drug Administration (FDA) for its diabetes drug.

Dixon shares ended 2% higher on the back of its acquisition of a 51% stake in Q Tech India.

Schneider surged 3% after Bloomberg reported that the company is in talks to buy Temasek’s stake in the Indian JV.

A draft notification by the Karnataka government proposing a uniform cap of ₹200 (tax inclusive) on movie ticket prices across all theatres and multiplexes led to PVR and Inox closing 1% lower on Wednesday.

Globally, European markets traded higher, while US stock futures indicate a weak start on Wall Street. Oil prices snapped a two-session losing streak.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <