Retail investors cheered HandsOn Global’s acquisition of US-based Aidéo Technologies.

HandsOn Global Management (HOV) shares hit the upper circuit on the NSE on Wednesday after its board approved the acquisition of Aidéo Technologies.

At the time of writing, HOV shares were up 5% at ₹64.17.

Aidéo Acquisition

HandsOn Global Management approved the acquisition of a 100% equity stake in Aidéo Technologies LLC. This US-based firm offers AI-powered autonomous medical coding platforms in the revenue cycle management (RCM) space.

The acquisition will be carried out through Healthcare Capital Holdings (HCH), a wholly owned subsidiary of the company. As part of the transaction, HCH will issue Class B Preferred Stock to the sellers at a total consideration of ₹14.08 crore.

It will help HOV develop a comprehensive AI-driven healthcare services platform. Aidéo’s autonomous coding platform is powered by advanced AI, natural language processing, real-time analytics, and large language models.

With HL7 interoperability, the platform works with industry-standard electronic health record (EHR) systems. It supports a wide range of specialties, including surgery, emergency care, anesthesia, radiology, and RCM companies across the U.S.

Thumbs Up From Retail

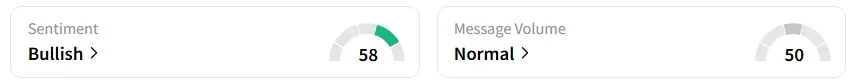

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

The stock has been under some selling pressure this year, having lost over 21%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<