The research firm flagged weakness in the home improvement retail sector, calling it "at best stagnant and potentially deteriorating.”

- Stifel downgraded HD stock to ‘Hold’ from ‘Buy,’ a departure from the majority analyst view.

- The research firm flagged weakness in the home improvement retail sector, calling it “stagnant.”

- Home Depot will report its quarterly results next Tuesday.

Home Depot, Inc.’s shares declined 0.5% in the early premarket session on Friday after Stifel downgraded its stock on weakness in the home improvement retail sector.

The research firm slashed its rating to ‘Hold’ from ‘Buy,’ a break from the majority analyst view, and price target to $370 from $440. The new target is just $2 above the stock’s last close.

Several notable brokerages, including Wells Fargo, JPMorgan, and Bernstein, have lowered their price targets over the last two weeks, amid a sharp decline in the stock.

Why The Downgrade?

In their investor note, Stifel analysts flagged weakness in the home improvement retail sector, describing it as "at best stagnant and potentially deteriorating."

They reduced their earnings estimates for Home Depot for the second half of fiscal 2025 through fiscal 2027, positioning its forecasts "meaningfully below consensus" due to expectations of a delayed recovery in the home improvement category.

Retail Stays Bullish

Currently, 25 of the 37 analysts covering the stock have a ‘Buy’ or higher rating, 11 recommend ‘Hold,’ and one advises ‘Strong Sell,’ according to Koyfin data. Their average price target is $435.25.

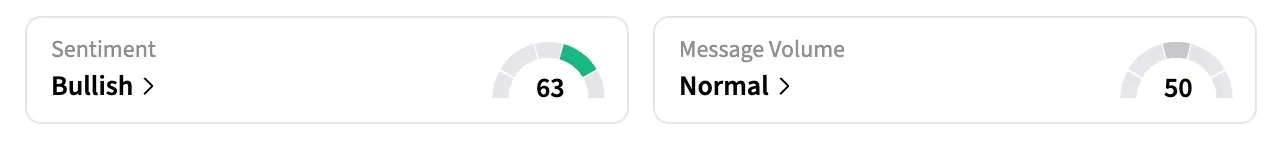

HD stock has dropped by over 13% since a recent high on Sept. 11 and is down 5.4% from the start of the year. On Stocktwits, the retail sentiment climbed a few points higher in the ‘bullish’ zone.

All Eyes On Earnings Now

Home Depot will report its quarterly earnings next Tuesday. Analysts expect its third-quarter revenue to grow 2.3% to $41.15 billion, which would be the slowest pace of growth since the second quarter last year. Adjusted EPS is expected to rise 4.6% to $3.84.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<