HAL’s stock broke key resistance and shows bullish momentum. Analyst recommends a buy with targets up to ₹5,100.

Hindustan Aeronautics Limited (HAL) shares pared some gains post its March quarter earnings announcement.

They traded 3% higher in afternoon trade on Wednesday with SEBI-registered research analyst Prabhat Mittal offering a bullish outlook on the defense PSU.

HAL reported a net profit of ₹3,958 crore, marking an 8% year-on-year decline for the fourth quarter. Despite the earnings dip, the stock is showing strong technical resilience and upward momentum.

According to Mittal, HAL recently broke past a critical resistance level at ₹4,677, and is currently trading at ₹4,732.

He points out that the stock has been forming a pattern of higher highs and higher lows, a hallmark of short-term bullish sentiment.

Adding to the positive outlook, HAL is taking support along an upward sloping trendline and is trading above its 20, 50, 100, and 200-day moving averages. These factors collectively indicate strength in the underlying trend.

Mittal recommends that traders consider buying HAL at current levels down to ₹4,677, with a strict stop-loss at ₹4,449. He pegs the target range between ₹4,900 and ₹5,100, indicating a potential upside of nearly 8%.

HAL’s robust order pipeline is also adding to this optimism.

The company recently disclosed manufacturing contracts worth ₹1.02 lakh crore, along with repair and overhaul (RoH) agreements totaling ₹17,500 crore.

HAL aims to scale its order book to ₹2.6 lakh crore by FY26, a significant jump that strengthens the long-term investment narrative.

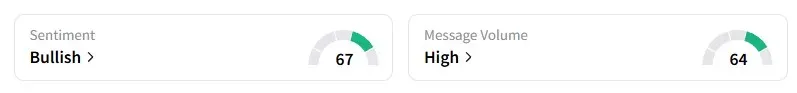

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

HAL shares gained 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<