GST Council’s rate cuts spurred optimism across consumption sectors.

Strong start on Dalal Street as Indian equity markets were powered by the GST Council’s sweeping rate cuts. The move has shifted several consumption categories into lower tax brackets, igniting hopes of a demand revival. The Nifty index opened above the 24,900 level.

At 09:45 a.m. IST, the Nifty 50 traded 175 points higher at 24,890, while the Sensex was up 623 points at 81,190. Broader markets held the ground, with the Nifty Midcap index rising 0.2% and the Smallcap index trading 0.1% higher.

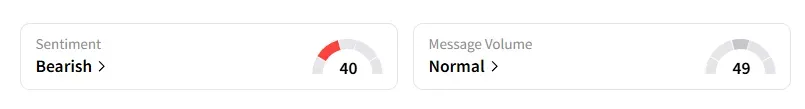

However, the retail sentiment on Stocktwits for Nifty remained ‘bearish’ at market open.

Stock Watch

Sectorally, barring technology, metals, and energy, the rest of the indices traded in the green. Autos were the top sectoral gainers, rising 2.4% followed by FMC, which rose 1.7%. M&M is the top gainer (+6%), followed by Eicher Motors (+3%), TVS, and Tata Motors (+1%) after GST on small cars, hybrids, and EV components was cut from 28% to 18%.

FMCG majors stand to gain as essentials like ghee, butter, paneer, juices, noodles, and wafers move from 12% to 5% GST. Beneficiaries include Bikaji, Gopal Snacks, Dabur, ITC, Britannia, Nestlé, Marico, and HUL, with improved affordability expected to boost volumes, said analyst Akhilesh Jat. Within consumer durables, he added that footwear stocks stole the spotlight, as GST on products under ₹ 2,500 was slashed to 5%. He believes Relaxo, Bata, Khadim, Metro, and Campus are poised to capture greater market share amid rising affordability. With GST cuts energizing consumption themes, investors are eyeing sharp near-term gains in staples, discretionary, and durable plays.

Cement and consumer durable stocks are the other beneficiaries of the GST rate revisions.

In other stocks, Campus Activewear gained 5% after the company acquired land and building to expand its footwear production capacity.

BHEL gained on bagging an order worth ₹2,600 crore.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Thursday with 1-week timeframe:

Britannia: Buy at ₹5,908, for a target price of ₹6,100 and stop loss at ₹5,840

Tata Consumer: Buy at ₹1,104, with target price at ₹1,210, and stop loss at ₹1,060

Tata Motors: Buy at ₹692, with a target price of ₹725, and stop loss at ₹580

Markets: The Road Ahead

SEBI-registered analysts on Stocktwits shared the trade setup.

Pradeep Carpenter noted that the GST cuts create a pro-consumption and pro-investment setup, and hence he expects rotation into autos, FMCG, durables, cement, and insurance stocks. He advised traders to focus on consumption, autos, cement, and insurance as key sectors for the day, while sin goods and luxury may underperform.

Global Cues

Globally, Asian markets traded higher, while crude oil prices declined in anticipation of the upcoming OPEC+ meeting this weekend, where producers are expected to discuss increasing production targets for October.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<