The company now expects net income attributable to shareholders for the full year to be $8.2 billion to $10.1 billion, down from its previous estimate of $11.2 billion to $12.5 billion.

Automaker General Motors (GM) on Thursday slashed its full-year guidance, saying it expects a $4 billion to $5 billion impact due to the Trump administration’s tariffs on imports.

The company now expects net income attributable to shareholders for the full year to be $8.2 billion to $10.1 billion, down from its previous estimate of $11.2 billion to $12.5 billion.

Adjusted earnings per share (EPS) for the year is expected to be in the $8.25-$10 range, down from the previous estimate of $11-$12.

The company now expects full-year adjusted automotive free cash flow of $7.5 billion to $10 billion, down from its previous guidance of $11 billion to $13 billion.

GM also anticipates offsetting at least 30% of the assumed $4 billion to $5 billion impact from tariffs, it said. The new adjusted auto free cash flow guidance enables the company to continue investing in U.S. manufacturing, it said.

The automaker already has a network of 50 U.S. manufacturing plants and parts facilities in 19 states, which includes 11 vehicle assembly plants.

CEO Mary Barra said in a letter to shareholders that the company looks forward to maintaining a strong dialogue with the administration on trade and other policies as they continue to evolve.

“As you know, there are ongoing discussions with key trade partners that may also have an impact. We will continue to be nimble and disciplined and update you as we know more,” Barra said.

GM suspended its previous guidance, issued in January, on Tuesday after noting that it did not account for the impact of tariffs on imported vehicles, materials, and auto parts.

For the first quarter, GM reported a 2.3% year-over-year (YoY) rise in its first-quarter revenue to $44.02 billion, exceeding an analyst estimate of $43.21 billion.

Adjusted earnings per share (EPS) for the quarter came in at $2.78, up 6.1% from the first quarter of 2024, and above an estimated $2.66.

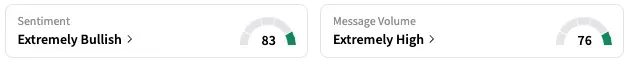

On Stocktwits, retail sentiment around GM stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

GM stock traded over 3% higher in Thursday’s pre-market.

The stock is down by about 12% this year but up by nearly 2% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<