BMO Capital downgraded First Solar and trimmed its target price for the stock, citing a potential overhang due to Tesla’s expansion into solar module manufacturing.

- BMO Capital downgraded First Solar to ‘Market Perform’ from ‘Outperform’ and cut its price target to $263 from $285.

- The firm believes Tesla’s efforts to build a vertically integrated solar manufacturing business are likely to take shape in the coming quarters.

- Tesla’s potential expansion into solar modules could create a lasting overhang on First Solar shares and pressure investor sentiment, BMO stated.

Shares of First Solar (FSLR) tanked more than 12% on Thursday after BMO Capital downgraded the stock and slashed its target price, citing a potential overhang due to Tesla’s expansion into solar module manufacturing.

FSLR shares are down to their lowest level in more than three months.

Why Did BMO Downgrade The Stock?

BMO Capital downgraded First Solar to ‘Market Perform’ from ‘Outperform’ and cut its price target to $263 from $285, according to The Fly. It still implies a 20% upside from current levels.

The firm initially dismissed Elon Musk’s comments on Tesla building a vertically integrated solar manufacturing business as “aspirational,” but it now believes the effort is likely to take shape in the coming quarters.

BMO Capital believes Tesla’s potential expansion into solar modules could create a lasting overhang on First Solar shares and pressure investor sentiment.

Last week at the World Economic Forum (WEF) in Davos, Musk said Tesla and SpaceX are targeting 100 gigawatts of annual solar manufacturing within three years. Musk reiterated the target in a call with analysts following Tesla’s fourth-quarter (Q4) results on Wednesday.

“We think the best way to add significant capability to the grid is, or energy to the grid, let’s say it’s powering AI data centers, is solar and batteries on Earth and solar in space. So that’s why we’re gonna work towards getting 100 gigawatts a year of solar cell production, integrating across the entire supply chain, from raw materials all the way to finished solar panels,” Musk said.

How Did Stocktwits Users React?

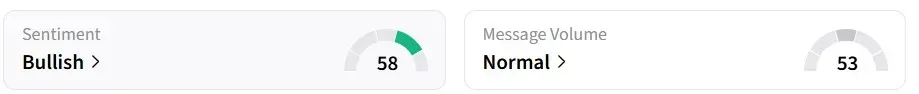

Despite the intra-day decline, retail sentiment on Stocktwits flipped to ‘bullish’ from ‘neutral’ a day earlier.

Retail chatter was mixed, with one user viewing the dip as a buying opportunity.

However, another user is expecting a further 25% downside.

The stock has gained more than 30% in the past year, though it has shed around 18% so far in 2026.

Read also: LMT Stock Jumps 6% In Pre-Market – What’s Driving The Rally?

For updates and corrections, email newsroom[at]stocktwits[dot]com<