The research firm forecasted a 30% rise in the beauty product company's stock.

BofA Securities has reinstated coverage on Estee Lauder (EL) with a 'Buy' rating and $110 price target, based on its assessment of the beauty products company's improving business in Asia and gains from a restructuring plan.

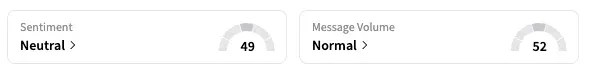

The vote of confidence, coming close on the heels of a price target hike from Wells Fargo, drove EL shares 6.3% higher to $92.10 on Thursday. On Stocktwits, the retail sentiment shited to 'neutral' from 'bearish' the previous day, with several users forecasting the stock to hit $100 in the near term.

BofA, whose new target signals a 30% upside in EL stock from the last close, said demand for Estee products in China is improving, which would support the company's earnings in the current quarter.

Estee, which sells skincare, makeup, fragrance, and hair care products under brands such as MAC, Clinique, and La Mer, has been facing particular weakness in China and travel retail channels in Asia.

The company responded by appointing a new chief executive and unveiling its "Beauty Reimagined" turnaround plan, which includes workforce reductions, a regional and brand reorganization, and enhanced supply-chain efficiency.

BofA said the plan would deliver gains, and forecast a 4% annual revenue growth and a 430 basis points of margin expansion at Estee by FY27.

Last month, Deutsche Bank upgraded the stock to "buy" from "hold." EL shares have increased by 22% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<