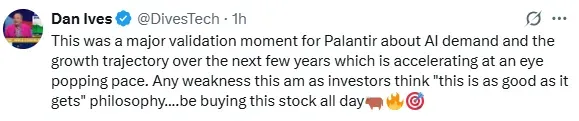

In a post on the X platform, Ives highlighted that Palantir’s latest performance signals momentum in the AI space.

- Palantir’s U.S. commercial business surged 121% year-over-year (YoY), outpacing Wall Street’s forecast of 85% growth.

- In a post on the X platform, Ives highlighted that Palantir’s latest performance signals momentum in the AI space.

Palantir Technologies Inc. (PLTR) received strong praise from Wedbush’s Dan Ives after reporting robust growth in its U.S. commercial segment in the third quarter (Q3), underscoring rising demand for artificial intelligence-driven solutions.

Ives described the results as a “major validation moment” for the company’s AI strategy and long-term outlook.

Strong Commercial Growth

In a post on the X platform, the analyst highlighted that Palantir’s latest performance signals accelerating momentum in the enterprise AI space, suggesting the firm’s growth path is expanding rapidly.

Palantir’s U.S. commercial business surged 121% year-over-year (YoY), significantly outpacing Wall Street’s forecast of 85% growth, cited Ives. The company also reported a total commercial contract value of $1.31 billion, marking a 342% YoY surge, while total remaining U.S. deal value reached $3.63 billion.

Palantir’s stock traded 7% lower in the premarket on Tuesday and was the top-trending equity ticker on Stocktwits.

Get updates to this developing story directly on Stocktwits.<