Following its U.S. launch, Coinbase claimed that its Kalshi-powered prediction markets are governed by the CFTC rather than state gaming laws.

- Despite Nevada regulators taking action to block Coinbase's prediction markets offering, COIN resisted regulatory pressure and held close to recent highs over the weekend.

- Nevada's Gaming Control Board requested an emergency court order to stop Coinbase's event-based contracts.

- ARK Invest also reduced its exposure to Coinbase by selling roughly $22 million worth of COIN across several ETFs and reallocated it to Bullish.

Coinbase Global Inc. (COIN) stayed close to its recent highs over the weekend. This was even though Nevada's Gaming Control Board tried to stop the exchange from letting state residents bet on sports and elections without a gaming license.

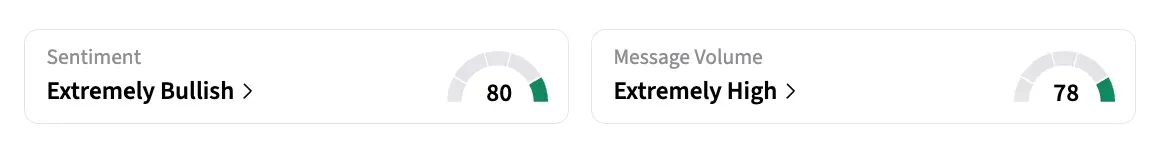

On Friday, COIN shares closed at $165.12, up 13% for the day. After hours, COIN stock was up 0.41%. As Coinbase continues to expand its product lines and capitalize on the improving sentiment in the cryptocurrency market.

The Gaming Control Board went to the Carson City district court to file a civil enforcement action. They asked for a permanent injunction and declaratory relief, as well as an ex parte temporary restraining order to stop Coinbase from offering event contracts on its mobile app in Nevada right away.

The board said that under Nevada law, sports event contracts and some other event-based contracts count as gambling, so they need a state license. Regulators also pointed out that Coinbase lets people 18 and older trade the contracts, even though Nevada has a minimum age of 21 for gambling.

Last month, Coinbase launched its U.S. prediction markets product in partnership with Kalshi, a Commodity Futures Trading Commission (CFTC)-registered designated contract market. The company says that prediction markets are under federal law and that the CFTC, not state gaming regulators, is in charge of the products.

Nevada's action comes after gaming regulators in Connecticut, Michigan, and Illinois told Coinbase to stop doing business there. Coinbase is now fighting these orders in federal court. Coinbase said in those filings that state enforcement efforts "stifle innovation and violate the law," and that the CFTC is the only agency that can oversee regulated prediction markets.

Ark Invest Sells COIN Stock

In a similar vein, Cathie Wood's ARK Invest continued to reduce its exposure to Coinbase on Friday by reallocating funds to the digital asset platform Bullish and selling about $22 million worth of COIN shares across several exchange-traded funds.

Read also: ‘A Lot Less Dependable’: Jim Cramer Warns Robinhood’s Bitcoin Exposure Is Spooking Investors

For updates and corrections, email newsroom[at]stocktwits[dot]com<