Tom Lee agreed with a user on X who postulated that Bitcoin’s current cycle has unfolded entirely during U.S. manufacturing contraction.

- PMI readings below 50 have historically aligned with liquidity rebuilding phases.

- Past Bitcoin peaks occurred only after manufacturing activity returned to expansion.

- Lee views recent volatility as positioning rather than exhaustion.

Bitmine Immersion Technologies (BMNR) chairman Tom Lee said Tuesday that Bitcoin (BTC) has likely not reached its cycle peak, pointing to a macro pattern that has held across every major rally in the asset’s history.

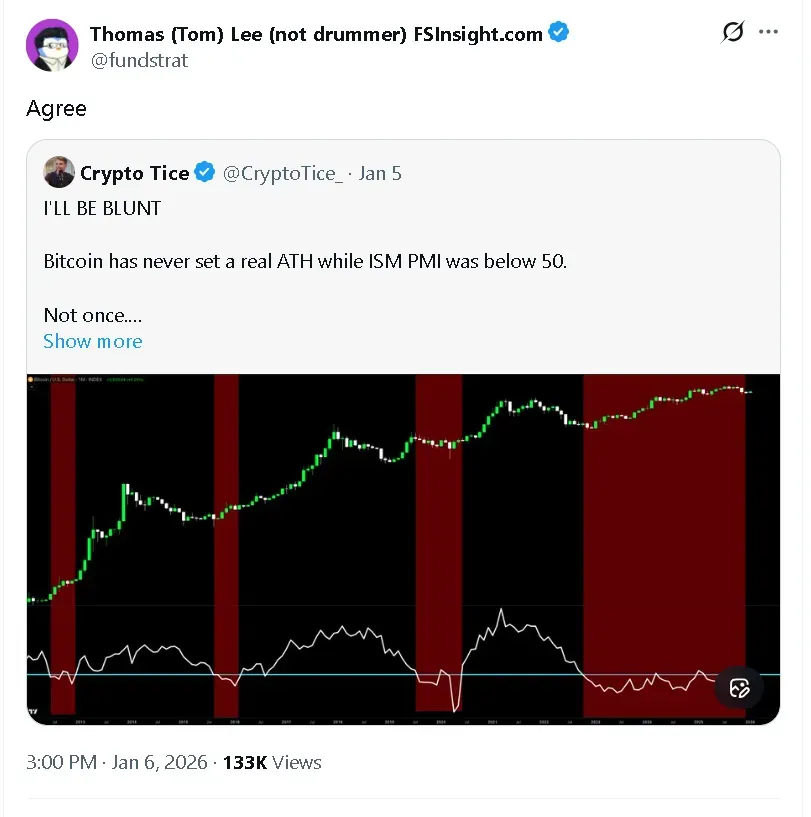

In a post on X, Lee agreed with another user who noted that Bitcoin has never set a lasting all-time high during a period of U.S. manufacturing contraction. The user highlighted that the ISM Manufacturing Purchasing Managers’ Index has remained below 50 during Bitcoin’s gains during the current cycle. Readings below 50 signal contraction rather than expansion in manufacturing.

Bitcoin’s price edged 0.5% lower in the last 24 hours to around $92,800, still trying to break past the resistance at $93,000 after crossing it for short bouts throughout this week. On Stocktwits, retail sentiment around the apex cryptocurrency in ‘extremely bullish’ territory over the past day amid ‘high’ levels of chatter.

PMI Contraction Has Preceded Bitcoin Peaks, Not Defined Them

Historically, when the PMI reading is below 50, it has aligned with Bitcoin accumulation rather than market tops.

PMI readings below 50 typically indicate a slowdown in economic activity, limited capital spending, and cautious corporate behavior. For financial markets, that environment is often associated with liquidity building rather than tightening.

In previous Bitcoin cycles, major peaks for the apex cryptocurrency’s price emerged only after manufacturing activity recovered. Such shifts have tended to align with a broader return in risk appetite across equities and other speculative assets, such as Bitcoin.

Bitcoin Accumulation, Not Distribution

The user whose analysis Lee endorsed, Crypto Tice, also said the continuous PMI contraction helps explain why Bitcoin has struggled to establish a definitive cycle top despite repeated rallies. He forecast that the macro backdrop suggests positioning and consolidation remain ongoing, instead of being a signal of exhaustion.

“So no, this is not the Bitcoin top. It’s the part of the cycle people misread every time,” wrote CryptoTice.

In an interview last month, Lee noted that other markets once governed by reliable timing patterns, such as ISM manufacturing data, copper, and gold, have broken away from old rhythms. “If Bitcoin makes a new high in January, there’s no four-year cycle,” he said. The cycle “was true in the past — until this cycle,” Lee added.

Lee’s Bitmine Immersion Technology is the largest corporate Ethereum (ETH) digital asset treasury in the world. The company currently has 4.14 ETH in its coffers, valued at around $13.51 billion, according to CoinGecko data.

BMNR’s stock rose nearly 1.9% in after-hours trade to $32.94. Retail sentiment around the company on Stocktwits trended in ‘bullish’ territory, accompanied by ‘high’ levels of chatter over the past day. Some of that momentum came from MSCI’s decision to continue including digital asset treasuries (DATs) across its indexes.

Meanwhile, Ethereum’s price rose 1.1% in the last 24 hours to $3,250. Despite the uptick, the leading altcoin remains nearly 35% below it record high of nearly $5,000, seen five months go. On Stocktwits, retail sentiment around ETH trended in ‘bullish’ territory over the past day while chatter remained at ‘high’ levels.

Read also: Arthur Hayes Calls On Binance, Bybit To List This Crypto Token After It Hit A Record High

For updates and corrections, email newsroom[at]stocktwits[dot]com.<