Block is cutting up to 10% of staff to boost profitability as Cash App expands Bitcoin features tied to its broader efficiency push.

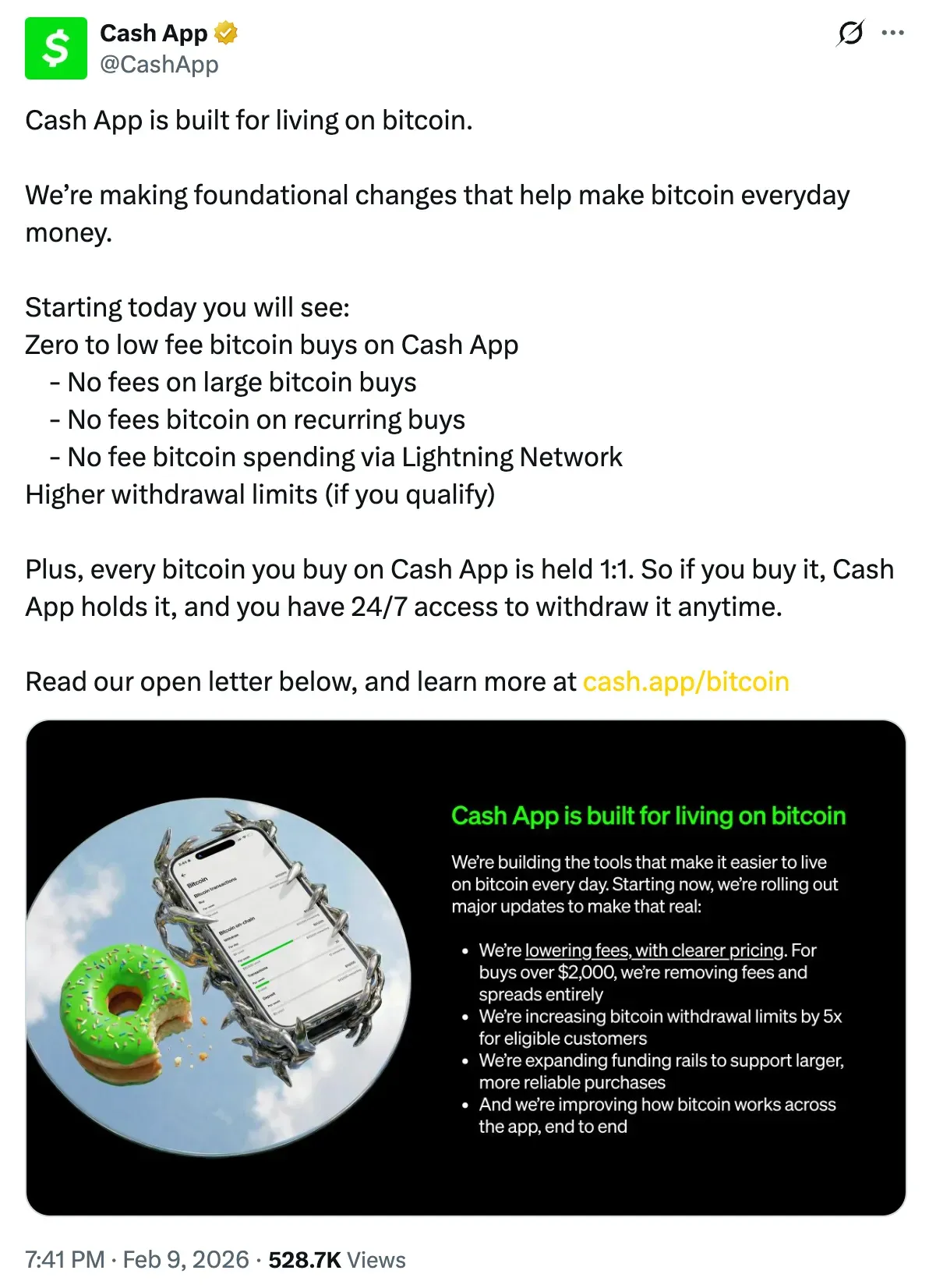

- Cash App said it will roll out zero-to-low fee Bitcoin purchases, no fees on large or recurring buys, fee-free Bitcoin spending via the Lightning Network, and higher withdrawal limits for eligible users.

- The announcement came as Block Inc prepared to reduce its workforce by up to 10% as part of an efficiency push tied to year-end reviews.

- Block had been restructuring since 2024, working to integrate Cash App with Square while expanding initiatives across Bitcoin, artificial intelligence, and mining.

Block Inc. (XYZ)-backed Cash App rolled out new Bitcoin (BTC) features on Monday amid the parent company’s cost-cutting drive aimed at improving profitability, including plans to reduce its workforce by up to 10%.

In a post on X, the updates include lower and clearer fees, with no fees or spreads for Bitcoin purchases over $2,000, and higher limits on Bitcoin withdrawals. It also includes more ways to fund purchases that are bigger and more reliable, and improvements to how Bitcoin works throughout the app. The limit, CashApp explained, could be up to five times as much for people who are eligible.

According to Cash App, these changes are "foundational" and meant to make Bitcoin a usable form of money, not just a passive investment. Lightspark founder and former PayPal (PYUSD) president David Marcus reacted positively, calling the move “amazing.” Cash App has supported Bitcoin trading and withdrawals since 2018, and the latest announcement represents an expansion of its existing Bitcoin features rather than a first-time rollout.

Block Inc (XYZ) closed at $56.78, up 1.45% on Monday. In the after-hours, the stock saw an additional 0.30% gain. On Stocktwits, retail sentiment around the company improved from ‘bearish’ to ‘neutral’ territory, as chatter remained at ‘high’ levels over the past day.

Business Overhaul Amid Cost Pressure

Bloomberg reported that Block had been reworking its staffing and operating model since 2024 to run more efficiently and meet aggressive profitability targets. The company sought to better integrate its peer-to-peer payments platform Cash App with its merchant-focused Square business, while also expanding initiatives in Bitcoin, artificial intelligence, and its mining unit, Proto.

Block is scheduled to report earnings after the market closes on February 26. Analysts expect the company to post adjusted fourth-quarter (Q4) earnings of $403 million on revenue of $6.25 billion, Bloomberg said. Jack Dorsey’s company is reportedly preparing to cut up to 10% of its workforce.

Block notified employees during annual performance reviews that their roles may be eliminated as part of a wider business overhaul. The company had fewer than 11,000 employees as of late November, as per Bloomberg’s report.

The reductions are being carried out across multiple teams as part of Block’s year-end performance review process, which is expected to run through late February. The move aligns with financial targets executives outlined at an investor day last year, where Block said it aimed to generate nearly $12 billion in gross profit by 2026, with growth projected in the mid-teens range through 2028.

The current round of cuts would mark at least the third wave of workforce reductions at Block in the last few years. In January 2024, the company eliminated roughly 1,000 roles, citing organizational changes and efficiency goals. Block also carried out another smaller round of layoffs in 2023, affecting several hundred employees as it restructured teams and reporting lines.

Read also: Bitcoin Isn’t Breaking: Bernstein Keeps $150K Target Intact

For updates and corrections, email newsroom[at]stocktwits[dot]com<