Retail traders see the recent reset as a healthy consolidation, with today’s breakout and altcoin strength signaling renewed risk appetite and expectations for Bitcoin’s next move higher.

Bitcoin broke out to fresh all-time highs today, begging the question of whether this is the real deal or a fakeout. Stocktwits Sentiment and Message Volume suggest there’s room to run, and platform chatter shows retail sticking with the trade.

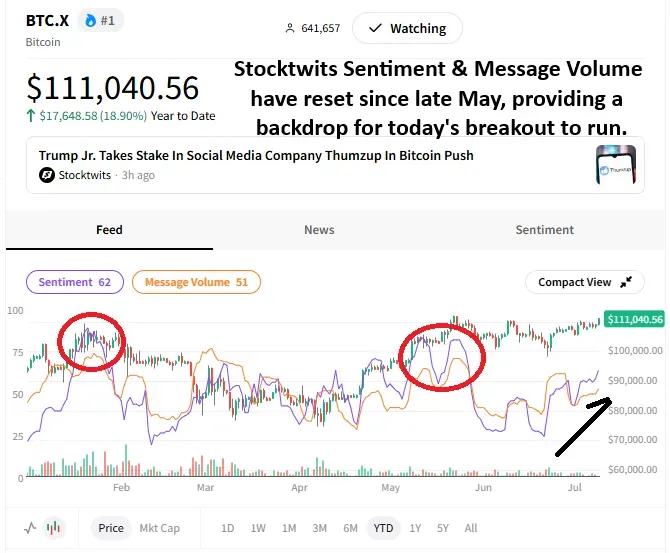

When prices become extended and one side of the trade becomes too crowded, it can be difficult for a trend to sustain itself in the short term. The last two times Bitcoin peaked above $100,000 (February and May), Stocktwits Sentiment and Message Volume were in “extreme territory,” leaving little room for the next marginal buyer.

When Bitcoin reached $110,000 in May, it had already experienced a 50% rally off its April lows in just six weeks, making it difficult for bulls to get on board. Now, with prices resetting at this higher range, it’s clear to buyers they won’t be getting a bargain at lower levels. This clean technical setup gives them the confidence that they’re buying a fresh breakout rather than chasing a long-in-the-tooth rally. Sentiment moving into ‘Bullish’ territory today quantifies their enthusiasm.

From both a sentiment and technical perspective, the recent reset is being viewed by traders as a healthy development. Today’s breakout to new highs and strength in the altcoin market suggest risk appetite remains strong and that the Stocktwits community is looking for the next leg of Bitcoin’s rally to begin.

Add $BTC.X to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto.

Unlock Stocktwits Sentiment insights with Stocktwits Edge — subscribe now.

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Lucid Motors as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.<