BEML shares have rallied over 30% in a month amid strong technical indicators. The analyst recommends buying on dips.

BEML shares rallied 8% on Friday, adding to its 30% gains in last one month. Recent news reports suggest the company is in the race to secure the Mumbai suburban rail network upgrade project.

SEBI-registered analyst Sameer Pande observed that on the monthly charts, the stock has shown a positive breakout on supertrend followed by its Relative Strength Index (RSI) around 63. The stock is seeing major resistance around ₹4,850 levels and strong support around ₹4,400-₹3,800, he added.

On the weekly charts, Pande notes that the stock has shown positive reversal signs with RSI around 68. BEML has already breached its previous resistance of ₹4,450. Going ahead, Pande sees resistance around ₹5,050-₹5,250, which, when breached, could lead to a significant rally.

On the daily charts, he noted that the RSI has jumped from 60 points on June 19 to 70 points on Friday. The stock is already trading near ₹4,680, overall showing strong positive momentum.

Pande recommends considering every fall as a buying opportunity, with strong support around ₹4,300-₹3,900-₹3,700.

BEML is a Public Sector Undertaking established in 1964. It operates in the manufacturing of Rail Coaches, Mining Equipment, Defence, and Metro.

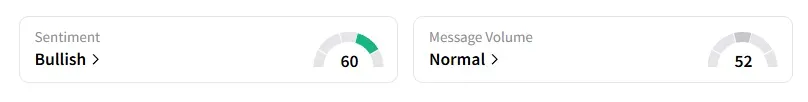

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago.

BEML shares have risen 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<