Analysts warn of further downside if key support at 24,850 fails to hold.

Indian equity markets extend their decline for the fourth consecutive week, ending at a one-month low. The benchmarks have marked their longest losing streak this year, with the Nifty ending below 25,900.

On Friday, the Sensex closed 721 points lower at 81,463, while the Nifty 50 ended 225 points lower at 24,837. Broader markets saw a sharp selloff, with the Nifty Midcap index falling 1.6% and the Smallcap index declining 2.1%.

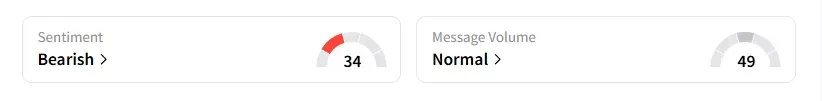

The retail investor sentiment surrounding the Nifty 50 remained ‘bearish’ by market close on Stocktwits.

Stock Moves

Sectorally, barring the pharmaceutical and healthcare sectors, the rest of the sub-indices ended in the red. Media (-2.6%), metals (-1.6%), oil & gas (-1.9%), autos (-1.3%), and IT (-1.5%) saw heavy selling.

Cipla was the top Nifty gainer, rising 3% on Q1 earnings beat.

On the other hand, concerns about asset quality sparked a selloff in Bajaj Finance shares (-5%). Analyst Sunil Kotak flagged a trendline retracement on weekly charts. He identified strong support around ₹870-₹890, with weakness seen below this range.

Bajaj Finserv also ended over 2% lower, despite a steady performance in the June quarter earnings, led by its lending and insurance businesses. Analyst Dhruv Tuli noted that the stock was consolidating in a tight range between ₹1,917 and ₹2,070, and its intraday fall was bought into, which is a bullish signal. A decisive closing above ₹2,070 is considered critical for validating fresh long positions. On the downside, support levels are identified at ₹1,917, followed by ₹1,860, and then the 200-day exponential moving average (EMA) zone.

Other earnings movers include Chennai Petroleum (-9%), Shriram Finance, HFCL, and Paras Defence (-4%), while Sharda Cropchem surged 20%.

IEX shares rebounded after a sharp crash yesterday, ending 10% higher.

Sona BLW Precision (Sona Comstar) shares ended 4% lower amid reports of a boardroom battle at the company.

Markets: What Next?

Analyst Manjushree Sharma said that based on the price structure, the next potential support zones appear to be around 24,780 and 24,500 for the Nifty. She added that if the index tests levels near 24,700, it may lead to increased volatility or a continuation of the existing trend.

Meanwhile, Vijay Kumar Gupta stated that a structural weakness was developing, as the Nifty breached a key support level with high volume. He believes that if the index fails to hold 24,850, we cannot rule out a rapid decline towards 24,500. Any pullback rally toward 25,030 could be a shorting opportunity unless a strong reversal is seen. As sentiment has turned defensive, he advised traders to protect long exposure or shift to capital preservation.

Globally, European markets traded mixed, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <