The company is expected to post weak quarterly numbers, according to street estimates.

Bank of Baroda is set to report its Q1FY26 earnings later in the day, with reports indicating that the PSU bank could post a weak set of numbers due to poor interest income and low treasury gains.

Bank of Baroda is expected to declare a net profit of ₹18,467 crore, a net interest income of ₹48,115 crore, and a net interest margin of 2.69%, according to reports.

Despite the soft earnings expectations, the stock’s technical setup remains constructive.

After breaking out of a multi-year cup & handle pattern on the monthly chart and hitting an all-time high of ₹281.80 in 2024, the stock is now consolidating near ₹239, noted SEBI-registered analyst Rohit Mehta.

The analyst believes that the pause in momentum is healthy, as long as it sustains above the strong support zone of ₹170 - ₹180. A decisive move above ₹250 could revive upward momentum, with the long-term structure still bullish.

Bank of Baroda shares were 0.5% higher at ₹248.32 on Friday’s early trade.

From a fundamental perspective, the stock’s valuations remain attractive at 0.85x book value, and it has a dividend yield of 3.45%. However, concerns remain around its contingent liabilities, rising working capital days, and a low interest coverage ratio.

Its financial performance has been mixed in recent quarters. Last quarter, revenue rose 4.1%, but financing profit turned negative. Sequentially, profit before taxes dipped marginally by 0.35%, while EPS showed improvement, rising 3.97% sequentially and 5.65% year-on-year.

On the shareholding front, promoter stake remained unchanged at 63.97%. FIIs trimmed their holdings from 8.98% to 8.08%, while DIIs increased their stake to 18.79%.

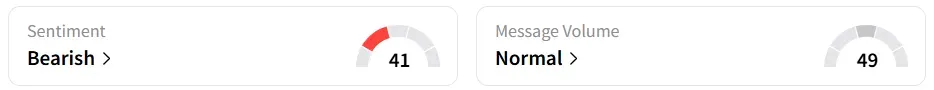

Ahead of the results, retail sentiment on Stocktwits shifted to ‘bearish’ from ‘neutral’ a week earlier.

Year-to-date, the stock has gained a marginal 3.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com<