Bernstein now projects a stronger demand for ASML’s advanced lithography systems in 2026 and 2027, particularly driven by expanding memory production.

- Bernstein upgraded ASML to ‘Outperform’ and raised its price target on the stock to $1,528 from $935.

- The firm also designated ASML as its top choice among European semiconductor equipment makers for 2026.

- Bernstein pointed to a looming “super cycle” in dynamic random-access memory (DRAM) chipmaking.

ASML Holding (ASML) has come on the retail investors’ radar on Monday, after Bernstein upgraded the stock to ‘Outperform’ from ‘Market Perform’, signaling confidence in the chipmaker’s prospects amid robust industry trends.

On Sunday, the firm also raised its price target on the stock to $1,528 from $935, according to TheFly.

ASML Demand Prospects

Bernstein now projects a stronger demand for ASML’s advanced lithography systems in 2026 and 2027, particularly driven by expanding memory production and advanced logic fabrication.

The firm also designated ASML as its top choice among European semiconductor equipment makers for 2026, underscoring expectations that the company will outpace regional peers in growth and share gains.

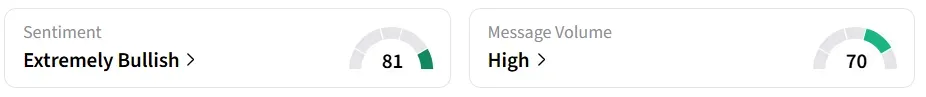

ASML stock traded over 2% higher in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

Memory Chip Gains

Bernstein pointed to a looming “super cycle” in dynamic random-access memory (DRAM) chipmaking. Major memory manufacturers plan significant capacity additions in 2026, with accelerated transitions to next-generation process nodes that require intensive use of lithography tools. This trend, the firm says, bodes well for ASML’s extreme ultraviolet (EUV) systems, which are critical for cutting-edge semiconductor production.

The firm’s rationale sits well at a time when global chipmakers continue to ramp investments in both memory and logic segments to support artificial intelligence and high-performance computing workloads.

ASML plays a key role in the global chip industry because it makes photolithography machines needed to produce cutting-edge semiconductors. China is a major customer for the company. However, in its latest quarterly earnings, ASML warned of a sharp decline in Chinese sales in 2026 due to tightening export restrictions.

According to a Reuters report, researchers in China are testing an early version of an advanced chipmaking machine that was reportedly recreated with help from former ASML employees.

ASML stock has gained over 51% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<