The FDA’s feedback supports a planned new drug application submission in the second half of 2026.

- Aspire does not expect to conduct additional studies beyond its currently planned multicenter crossover clinical trial.

- The firm said OTASA demonstrated faster and higher absorption of acetylsalicylic acid compared with chewed aspirin tablets.

- The company said that Early safety evaluations showed the product was well tolerated, with no adverse events reported.

Shares of Aspire Biopharma Holdings (ASBP) shot up 32% on Wednesday after the company said it received favorable feedback from the U.S. Food and Drug Administration (FDA) following a successful pre-investigational new drug (IND) meeting for OTASA, its high-dose sublingual (under-the-tongue) aspirin aimed at emergency treatment of suspected heart attacks.

The FDA’s feedback supports a planned Section 505(b)(2) New Drug Application (NDA) submission in the second half of 2026, the company added.

Based on the agency’s guidance, Aspire does not expect to conduct additional studies beyond its currently planned multicenter crossover clinical trial. The study will enroll 32 healthy volunteers and compare OTASA 162 mg with the current standard of care, two chewed 81 mg aspirin tablets, by measuring inhibition of serum thromboxane B2, a marker linked to blood clotting.

The pre-IND submission was supported by encouraging pilot clinical data. Aspire said OTASA demonstrated faster and higher absorption of acetylsalicylic acid compared with chewed aspirin tablets. The sublingual formulation also achieved rapid platelet inhibition, reducing thromboxane B2 levels within the first two minutes after administration. Early safety evaluations showed the product was well tolerated, with no adverse events reported.

How Did Stocktwits Users React?

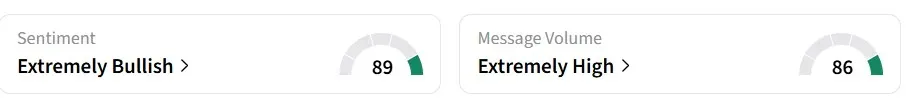

Retail sentiment on Stocktwits for ASBP remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes.

Users speculated that the company could already be engaged in licensing negotiations.

Stock Price

The update and the subsequent rally in stock price come at a time when the company has been dealing with listing concerns stemming from its low share price. In November, investors approved a proposal allowing the board to implement a reverse stock split at a ratio of 1-for-5 to 1-for-40, within one year if needed.

The company has also secured Nasdaq approval to remain listed, contingent on meeting minimum bid price and equity requirements by late January and mid-February 2026.

At present, the stock is trading near the $0.14 mark.

Read also: Silver Tumbles 5% Amid Profit-Booking And Scheduled Reshuffling Of Commodity Index Funds

For updates and corrections, email newsroom[at]stocktwits[dot]com.<