Following the Israel-Iran ceasefire, Adani Enterprises led a rally in Adani Group stocks. With strong support at ₹2,400 and bullish technical indicators, analyst sees potential upside for the stock.

Technical signals indicate favorable short and long-term prospects for Adani Enterprises, with a potential upside of nearly 14%, SEBI-registered analyst Deepak Pal said.

Over the past two weeks, Adani Enterprises stock has witnessed strong buying interest, particularly after the ceasefire agreement between Israel and Iran, noted Pal. The resolution triggered a positive rally across Adani Group stocks.

Adani Enterprises has surged nearly 10% over the past five sessions and is currently trading near its highest level in approximately seven months.

According to the analyst, the stock has found support at its 14-day exponential moving average (EMA) on the weekly chart. This move was significant as it broke above the previous high of ₹2,662 recorded on June 8 and closed above its key 55-day EMA, further confirming the bullish tone.

At the time of writing, the stock was trading at ₹2,620.

Technical indicators, including relative strength index (RSI) and moving average convergence/divergence (MACD), are also showing strong positive signals, reinforcing buying momentum.

The analyst views Adani Enterprises stock as a buying opportunity from both short-term and long-term perspectives, recommending a buy-on-dip strategy with ₹2,400 as a key support level. If the current upward momentum continues, the stock could potentially climb toward the ₹3,000 mark in the near term.

Last week, the company greenlit the public issuance of nonconvertible debentures (NCDs) of up to ₹1,000 crore. It also acquired Granthik Realtors for ₹86 crore via its joint venture AdaniConneX.

Adani Enterprises, the flagship company of the Gautam Adani-led Adani Group, has a P/E of around 38×–40×, ROE of about 15%–18%, ROCE of 15%, and a debt-to-equity ratio of 1.3–1.7×.

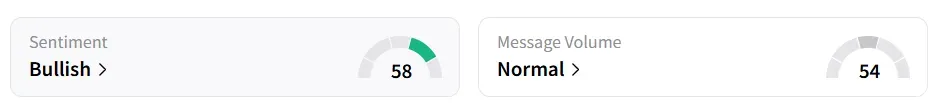

Retail sentiment around the firm on Stocktwits remains ‘bullish’.

Year-to-date (YTD), the stock has gained 3.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<