Analyst believes that Adani Energy may be forming a bullish base. He sees a potential breakout past ₹970.

SEBI-registered analyst Saurabh Sahu is bullish on Adani Energy Solutions, a key player in Adani Group’s expanding energy infrastructure portfolio, driven by its strong technical setup and fundamentals.

He notes that the stock has rebounded from 2023 lows of ₹550–600, and is now showing a pattern of higher highs and higher lows, which is a sign of recovery and trend reversal.

Sahu highlights the key resistance zone between ₹950 and ₹970 to watch for a potential breakout. Short-term support is seen at ₹800 and major support at ₹600

The Relative Strength Index (RSI) stands near 50–55, indicating strength without being overbought.

From a long-term perspective, the stock is consolidating after a massive rally in the past.

According to Sahu, this base-building phase may be laying the ground for the next uptrend.

He notes that early signs of a cup-and-handle or a rounding bottom formation are emerging, though volatility remains high.

He advises buying Adani Energy Solutions at the current level (₹874) and adding further if the stock corrects to ₹550–600, with a target at ₹1,800 in a 2-year holding period, and a stop loss of ₹450.

Fundamentally, he believes that Adani Energy is poised to gain from the government’s push for electrification and infra, making it a long-term thematic play.

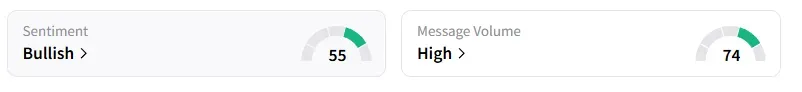

Data on Stocktwits shows retail sentiment turned ‘bullish’ from ‘bearish’ on this counter a day ago.

Adani Energy shares have gained 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<