The company said demand for Nociscan continued to accelerate through 2025, with scan volumes rising sharply across the U.S., the U.K., and Europe as new imaging centers and physician users came onboard.

- In 2025, Aclarion added nine imaging sites and more than 20 new physician users.

- The company reported a 69% increase in annual scan volume, capped by triple-digit growth in the fourth quarter.

- Looking to 2026, the company expects to speed up CLARITY trial enrollment, and roll out a new version of its software to improve workflow integration.

Aclarion, Inc. (ACON) stock shot up over 45% on Thursday’s premarket after the company shared an overview of its latest business progress and financial performance as it heads into 2026 and continues to develop its Nociscan platform.

The healthcare technology company focuses on helping physicians pinpoint the source of chronic lower back pain using biomarkers and advanced analytics embedded in its Nociscan platform.

Momentum Gained In 2025

Demand for Nociscan continued to accelerate through 2025, with scan volumes rising sharply across the U.S., the U.K., and Europe as new imaging centers and physician users came onboard.

In 2025, Aclarion added nine imaging sites and more than 20 new physician users. The company said these steps supported a 69% increase in annual scan volume, capped by triple-digit growth in the fourth quarter.

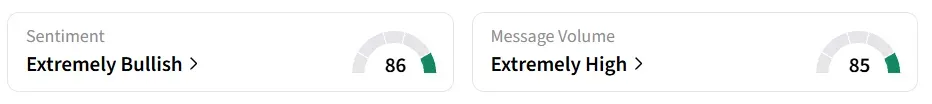

On Stocktwits, retail sentiment around Aclarion stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘low’ levels in 24 hours.

Aclarion launched its CLARITY trial in 2025, activating seven sites to evaluate real-world performance. The company also published data indicating Nociscan could lower per-patient costs and improve surgical success rates.

Plans For 2026

Looking to 2026, the company expects to speed up CLARITY trial enrollment, expand compatibility with additional MRI manufacturers, and roll out a new version of its software to improve workflow integration.

“We are pleased with the progress Aclarion has made in strengthening our financial position, expanding clinical traction, and advancing Nociscan toward broader adoption.”

- Brent Ness, CEO, Aclarion

As of the end of 2025, Aclarion reported $12 million in cash and no outstanding debt. Based on current spending levels, the company said it has sufficient resources to operate into the first half of 2027.

ACON stock has declined by over 99% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<