In a post on X, Peter Schiff stated that if Bitcoin’s price dips below $50,000, it is “highly likely” to keep falling until it hits $20,000.

- Bitcoin’s drop to $20,000 would represent an 85% fall from its October peak of over $126,000, Schiff said in a post on X.

- He dismissed concerns asking for a technical analysis, calling the volatility of Bitcoin’s price “a feature, not a bug.”

- Bernstein and Standard Chartered continue to project Bitcoin could reach $150,000 by year-end.

Long-time crypto critic and gold bull Peter Schiff brought back his call to “sell Bitcoin” on Thursday, warning that if the cryptocurrency falls to $50,000, there may be a deeper correction ahead.

“If Bitcoin breaks $50K, which looks likely, it seems highly likely it will at least test $20K,” he wrote in a post on X. “That would be an 84% drop from its ATH.” When asked if he had any technical analysis to support his hypothesis, Schiff simply replied, “Volatility is a feature, not a bug,” addressing the troughs and peaks of the crypto market.

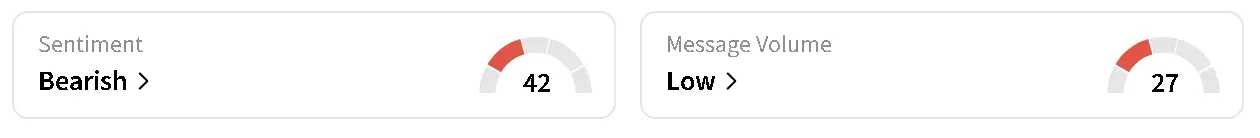

Bitcoin’s price was trading at around $67,800 on Friday morning, up 1.1% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency continued to trend in ‘bearish’ territory over the past day, amid ‘low’ levels of chatter.

The Bitcoin Doom Caller

Schiff ranks as the most frequent Bitcoin skeptic tracked by Bitcoin Deaths, a website that has logged declarations of Bitcoin's “dead” from critics, economists, and financial executives since 2010. He has predicted Bitcoin’s death at least 22 times overall, according to the tracker. Others listed include Steve Hanke, Warren Buffett, Nouriel Roubini, and JPMorgan CEO Jamie Dimon.

According to trackers like CryptoPotato, Schiff has issued more than 200 bearish calls since 2011. His earliest public warning dates back to June that year, when he criticized Bitcoin for lacking intrinsic value and called it a potential fad that could become worthless on his radio show.

His main argument for the drawdown in Bitcoin’s price since its record high of over $126,000 in October is that "more hype, leverage, and institutional ownership" make a crash worse.

However, other analysts have argued that institutional ownership also means deeper liquidity, regulated custody, and a significantly higher floor of structural demand that didn't exist during the crypto crashes of 2018 and 2022.

Bernstein and Standard Chartered have maintained their price target of $150,000 for Bitcoin by year-end, even amid the current dip in cryptocurrency markets. Traders are hoping that progress on the CLARITY Act will likely be a catalyst for Bitcoin’s price to move higher and break out of its current range below $70,000.

Read also: White House Takes Reins In Crypto-Bank Stablecoin Talks – Rewards Allowed But Penalties Proposed For Evasion: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.<