Banks can provide fresh lending support to vaccine manufactures, importers or suppliers of vaccines and priority medical devices; hospitals and dispensaries; pathology labs; manufacturers and suppliers of oxygen and ventilators; importers of vaccines and Covid-related drugs; logistics firms and patients for treatment.

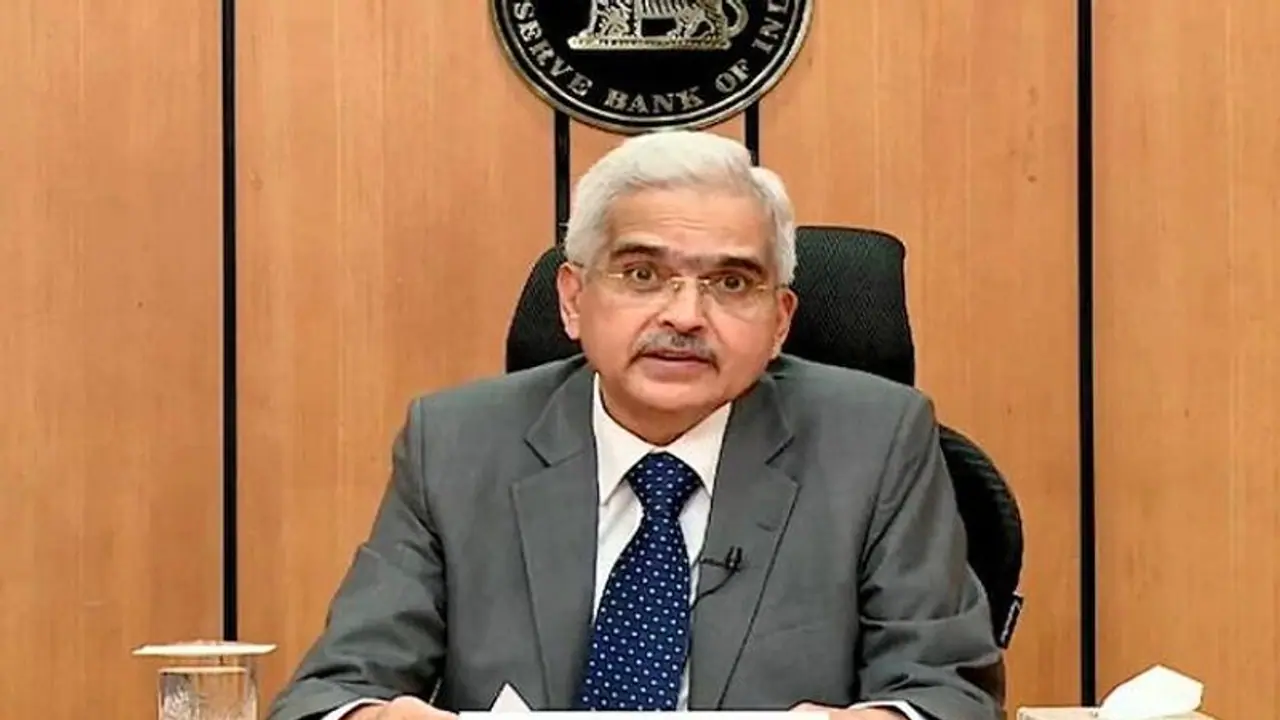

Reserve Bank of India Governor Shaktikanta Das on Wednesday announced Rs 50,000 crore liquidity for ramping up Covid-related healthcare infrastructure and services till 2022.

The announcement comes in the backdrop of the second wave of the pandemic sweeping across India.

In his unscheduled speech on Wednesday, the RBI Governor said that inflation went up to 5.5% in March 2021 from 5% a month ago due to a pick-up in food as well as fuel inflation. Core inflation remained elevated.

He also said that a normal monsoon forecast should help contain food price inflation.

The RBI governor made a slew of announcements. Let's take a look:

* Banks can provide fresh lending support to vaccine manufactures, importers or suppliers of vaccines and priority medical devices; hospitals and dispensaries; pathology labs; manufacturers and suppliers of oxygen and ventilators; importers of vaccines and Covid-related drugs; logistics firms and patients for treatment.

* To mitigate pandemic-related stress on banks and to enable capital conservation, banks are being allowed to utilise 100 per cent of floating provisions/counter-cyclical provisioning buffer held by them as of December 31, 2020, for making specific provisions for nonperforming assets with prior approval of their Boards. Such utilisation is permitted till March 31, 2022.

* To support small business units, micro and small industries, and other unorganised sector entities adversely affected during the current wave, it has been decided that till October 31, 2021, special three-year long-term repo operations of Rs 10,000 crore will be conducted at repo rate for the small finance banks, to be deployed for fresh lending of up to Rs 10 lakh per borrower.

* Small finance banks are now being permitted to reckon fresh lending to

smaller Micro Finance Institutions (with asset size of up to Rs 500 crore) for on-lending to individual borrowers as priority sector lending. This facility will be available up to March 31, 2022.

* Individuals and small businesses and MSMEs having aggregate exposure of up to Rs 25 crore and who have not availed restructuring under any of the earlier restructuring frameworks (including under the Resolution Framework 1.0 dated August 6, 2020), and who were classified as 'Standard' as on March 31, 2021, shall be eligible to be considered under Resolution Framework 2.0. Restructuring under the proposed framework may be invoked up to September 30, 2021, and shall have to be implemented within 90 days after invocation.

* It has been decided to rationalise certain components of the extant KYC norms. These include (a) extending the scope of video KYC known as V-CIP (video-based customer identification process) for new categories of customers such as proprietorship firms, authorised signatories and beneficial owners of Legal Entities and for periodic updation of KYC; (b) conversion of limited KYC accounts opened on the basis of Aadhaar e-KYC authentication in non-face-to-face mode to fully KYC-compliant accounts; (c) enabling the use of KYC Identifier of Centralised KYC Registry (CKYCR) for V-CIP and submission of electronic documents (including identity documents issued through DigiLocker) as identify proof; (d) introduction of more customer-friendly options, including the use of digital channels for the purpose of periodic updation of KYC details of customers.