RBI governor Shaktikanta Das also announced that the daily limit of IMPS transactions to Rs 5 lakh from earlier Rs 2 lakh earlier for the ease of consumers

The Reserve Bank of India (RBI)'s Monetary Policy Committee (MPC) on Friday kept the repo rate unchanged at 4% while maintaining an ‘accommodative stance’.

The committee ensured inflation remains within the target as long as necessary to revive and sustain growth and mitigate the impact of Covid-19 pandemic.

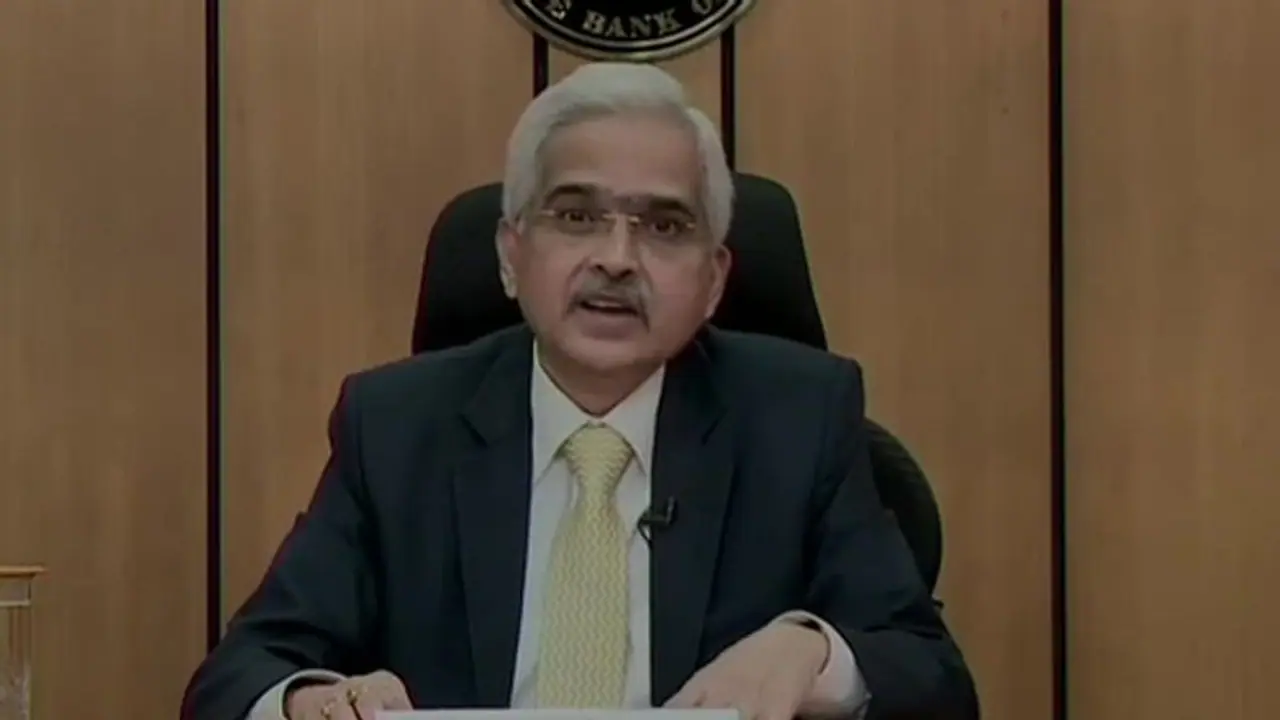

The six-member MPC, headed by governor Shaktikanta Das, met for three days from October 6.

Announcing the October bi-monthly monetary policy statement at 10am on this day, RBI governor Shaktikanta Das said, “Monetary policy stance remains accommodative as long as necessary to revive and sustain growth and mitigate the impact of the Covid-19 pandemic, while ensuring inflation remains within the target.”

Meanwhile, the RBI governor added that the MPC’s decision was taken unanimously and informed that the reverse repo rate too was kept unchanged at 3.35%. Separately, the Marginal Standing Facility (MSF) rate and bank rate were also kept unchanged at 4.25%.

Also read: Reliance Retail to launch 7-Eleven convenience stores in India, first one in Mumbai

RBI governor Shaktikanta Das announced that the daily limit of IMPS transactions to Rs 5 lakh from earlier Rs 2 lakh earlier for the ease of consumers.

There has been a corresponding increase in settlement cycles of IMPS, thereby reducing the credit and settlement risks, with RTGS now operational round the clock.

“In view of the importance of the IMPS system in the processing of domestic payment transactions, it is proposed to increase the per-transaction limit from Rs 2 lakh to Rs 5 lakh for channels other than SMS and IVRS. This will lead to further increase in digital payments and will provide an additional facility to customers for making digital payments beyond Rs 2 lakh," the RBI governor said.

The Reserve Bank of India on Friday also retained the projection for real GDP growth at 9.5% for the financial year 2021-22. This consists of 7.9% in Q2, 6.8 per cent in Q3 and 6.1% in Q4 of FY 2021-22. The real GDP growth for Q1 of FY 2022-23 was projected at 17.2%.