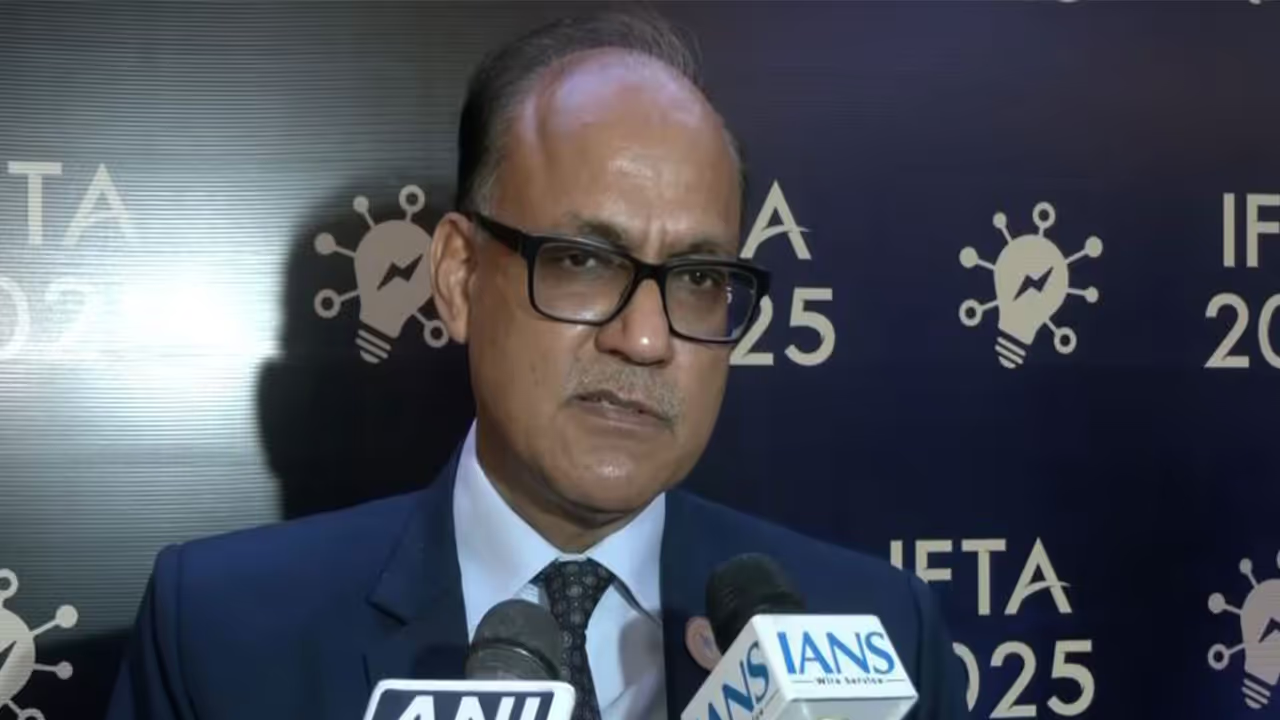

SBI MD Ashwini Kumar Tewari said banks are exploring ways to retrieve funds in fraud cases. He noted that suggestions to temporarily hold UPI payments are being discussed, but any decision lies with regulators like RBI and NPCI, not individual banks.

Regulatory Role in Tackling Digital Payment Fraud

State Bank of India Managing Director (Corporate Banking and Subsidiaries) Ashwini Kumar Tewari on Wednesday said the banking system in India is looking at ways and means to help customers retrieve funds in cases of fraud or inadvertent transactions, but stressed that any move to introduce any mechanism must come from regulators such as RBI and NPCI.

Referring to suggestions that UPI payments could be held temporarily before settlement, Tewari said there have been suggestions from a few quarters. "Nothing has moved ahead so far. This falls under the domain of RBI and NPCI, and they will have to decide it. No single bank can decide upon it, whether a UPI payment can be freezed for 30 minutes (or so and so). Deliberations are underway, with suggestions from many. Nothing has been finalised yet," he said, talking to reporters here.

AI Integration Across the Banking Sector

Tewari also detailed the extensive integration of artificial intelligence across the banking sector. "Banking sector is using AI, largely in three to four areas, serving customers in choosing products - we can fine-tune, in other words, hyper-personalisation, protection from fraud risks and for cyber security, better marketing, and AI chatbots for customers and staff. AI is being used in all areas. AI can process large data and give solutions quickly, which otherwise may take time to do it manually," he added.

Managing Risks of Emerging Technologies

He emphasised that managing the risks associated with emerging technologies is essential. "Every technology has its own upside and downside, and as banks, we need to make our customers more aware, and stay ahead of the curve in terms of technology models vis-a-vis fraudsters, so that misuse of AI can be stopped," he noted.

His remarks come as digital payment volumes rise and regulators weigh potential mechanisms to strengthen customer protection. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)