As reported by Bloomberg, Adani's net worth surged to $100.7 billion on Wednesday, positioning him as the 12th wealthiest individual globally. The news agency further indicated that Adani has reclaimed $16.4 billion in wealth this year.

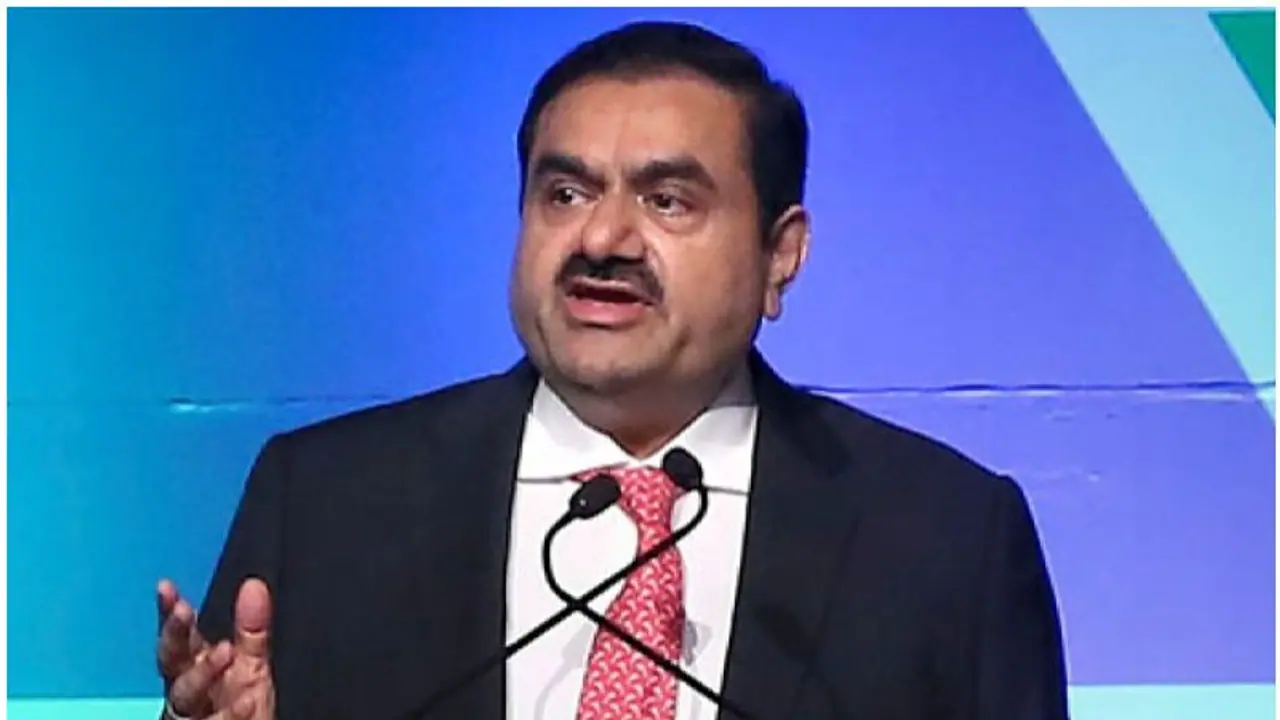

Gautam Adani, chairman of the Adani Group, has reentered the $100 billion league after substantially restoring his wealth subsequent to the assault by US-based short-seller Hindenburg Research in 2023. As reported by Bloomberg, Adani's net worth surged to $100.7 billion on Wednesday, positioning him as the 12th wealthiest individual globally. The news agency further indicated that Adani has reclaimed $16.4 billion in wealth this year.

After facing accusations of market manipulation and fraud, Adani's fortune plummeted by more than $80 billion before staging a remarkable recovery. His conglomerate, which experienced a market value decline of over $150 billion at one point, embarked on an extensive campaign to regain investor confidence and address regulatory concerns. Through months of efforts, including debt repayment and investor reassurance, the group successfully attracted new capital from prominent investors such as GQG Partners LLC. and Qatar Investment Authority in 2023.

GQG Partners LLC., led by Rajiv Jain, injected approximately $4 billion into Adani Group companies last year, while the Qatar Investment Authority committed nearly $500 million and TotalEnergies SE partnered with Adani Green Energy in a $300 million joint venture.

As a result of this resurgence, Gautam Adani currently ranks as the 12th wealthiest individual globally, trailing just behind Mukesh Ambani, according to the Bloomberg Billionaires Index.

Despite his recent recovery, Adani's fortune remains approximately $50 billion below its peak in 2022.

In January, the Supreme Court of India instructed the market regulator, Sebi, to conclude its investigation into the conglomerate within three months, signaling an end to further probes. This decision contributed to a rise in the conglomerate's shares.

Also read: IMF warns Maldives of 'high risk of foreign debt distress' amid growing ties with China

Gautam Adani, aged 61, abandoned college in the early 1980s to venture into Mumbai's diamond industry before transitioning to coal and ports. Over time, his empire has diversified into various sectors including airports, data centers, media, and green energy.

Adani's resurgence, alongside the broader increase in wealth in India, coincides with heightened global investor interest in the country. Major financial institutions such as Goldman Sachs Group Inc. and Morgan Stanley have identified India as a primary investment destination for the coming decade.