Amid concerns over banks' exposure to the embattled Adani Group, the Reserve Bank on Friday said India's banking sector is resilient and stable, and the central bank maintains constant vigil on the lenders.

In response to worries over banks' exposure to the troubled Adani Group, the Reserve Bank of India stated on Friday that the country's banking industry is robust and stable, and the central bank keeps a close eye on the lenders.

The Reserve Bank responded in a statement to media reports expressing worry over the exposure of Indian banks to a "business conglomerate" by stating that it is constantly monitoring the banking industry. The Adani Group, however, was not mentioned by the RBI.

Also read: No immediate impact on Adani entities' ratings following Hindenburg report: Fitch Ratings

As per the current assessment, the RBI said, "the banking sector remains resilient and stable. Various parameters relating to capital adequacy, asset quality, liquidity, provision coverage and profitability are healthy."

"As the regulator and supervisor, the RBI maintains a constant vigil on the banking sector and on individual banks with a view to maintain financial stability. The RBI has a Central Repository of Information on Large Credits (CRILC) database system where the banks report their exposure of Rs 5 crore and above which is used for monitoring purposes," the central bank said.

According to the statement, the RBI is attentive and keeps tabs on the soundness of the Indian banking industry. Additionally, it stated that banks complied with the Large Exposure Framework (LEF) rules set down by the RBI.

Earlier today, SBI Chairman Dinesh Khara said SBI's total exposure to the embattled Adani Group is 0.88 per cent of the book or about Rs 27,000 crore, and the country's largest lender does not envisage any setback on its bets.

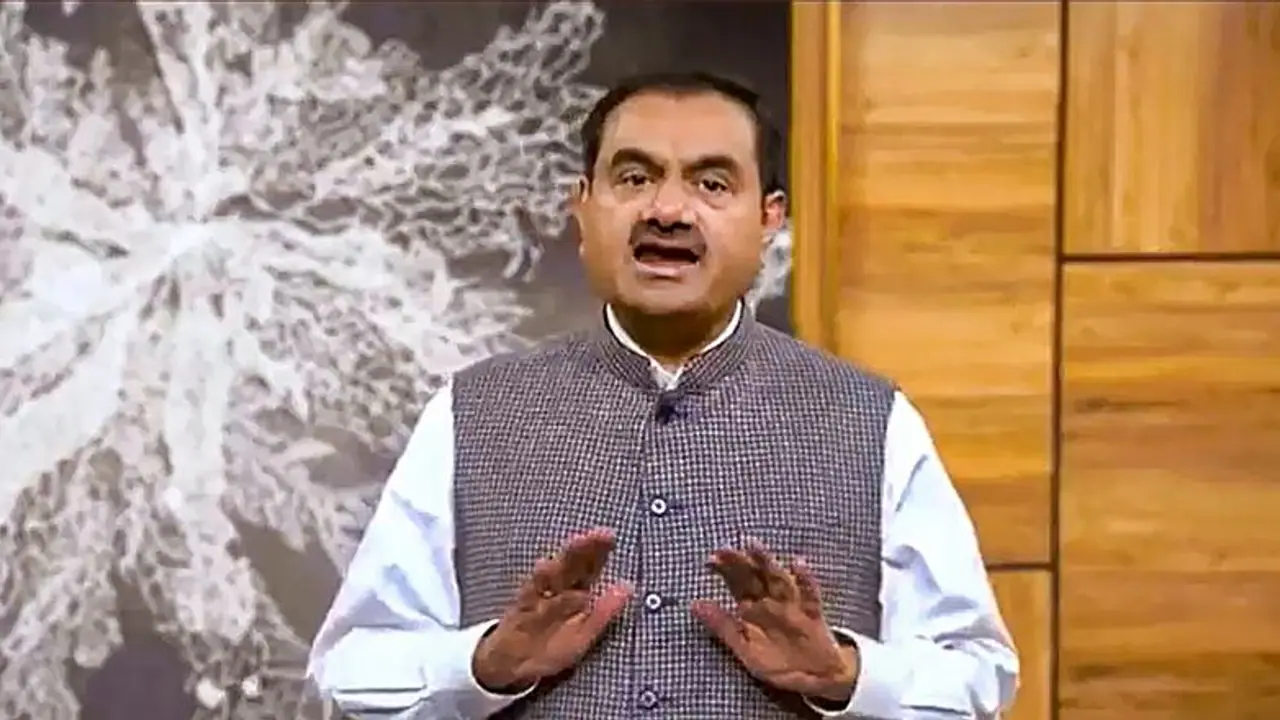

Also read: Gautam Adani no longer among world's top 20 richest people

At a time when the group's share prices are getting hammered, the government-owned lender said it has not extended any loans against shares to the ports-to-mining group.

Speaking to reporters after the results announcement, Khara clarified that the non-fund exposure is limited to letters of credit and performance bank guarantees and is not related to any equity raising or acquisition activities of the Gautam Adani-led group.

"As far as the quantum is concerned, that is 0.88 per cent of our total loan book we, don't envisage any kind of a challenge in terms of their ability to service the loan obligations which they have taken," Khara said, adding the group has excellent repayment record.

"Also, we have not extended any loans against shares etc.; there is no such portfolio which we have," he noted.

The going has been tough for the Adani Group over the last week since the release of a report by US short-seller Hindenburg Research made allegations of fraudulent transactions and share price manipulation. The Adani Group cancelled a Rs 20,000 crore share sale a day after the issue was fully subscribed.

Amid the sharp corrections in its stock since last week, the country's largest lender had sought to assuage investor concerns by clarifying that cash-generating assets fully secure its exposure to Adani Group.

(With inputs from PTI)