RBI keeps key lending rate unchanged at 6.5% for 4th consecutive time; check details

Synopsis

Governor Das pointed out that while inflation is expected to decrease in September, uncertainties cloud the overall outlook. The RBI anticipates retail inflation to reach 5.4% for the current fiscal year and reduce to 5.2% in the next fiscal year.

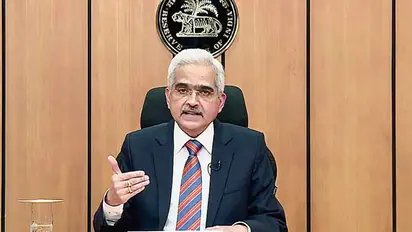

The Reserve Bank of India (RBI) on Friday opted to maintain its key lending rate at 6.5% for the fourth consecutive time, as announced by RBI Governor Shaktikanta Das during the bi-monthly Monetary Policy Committee (MPC) meeting. This decision implies that interest rates on loans are likely to remain unchanged.

Governor Das pointed out that while inflation is expected to decrease in September, uncertainties cloud the overall outlook. The RBI anticipates retail inflation to reach 5.4% for the current fiscal year and reduce to 5.2% in the next fiscal year. However, he cautioned that food inflation may not see sustained easing in the October-December quarter.

The MPC convened against the backdrop of rising inflation, with August's figure reaching 6.83%. Data for the current month is expected soon, and the government has set a target for the RBI to maintain retail inflation at 4%, with a 2% margin on either side.

Governor Das emphasized the importance of the monetary policy's readiness to address sudden food and fuel price increases. He also noted that the domestic economy has shown resilience, driven by strong demand.

Additionally, the RBI maintained its GDP growth projection for the current fiscal year at 6.5%, with Governor Das highlighting India's potential to become a new global growth engine.

Governor Das mentioned that the banking system remains robust, supported by improved asset quality. He indicated that the central bank may need to consider open market operations for government securities to manage liquidity effectively.

Stay updated with the Breaking News Today and Latest News from across India and around the world. Get real-time updates, in-depth analysis, and comprehensive coverage of India News, World News, Indian Defence News, Kerala News, and Karnataka News. From politics to current affairs, follow every major story as it unfolds. Get real-time updates from IMD on major cities weather forecasts, including Rain alerts, Cyclone warnings, and temperature trends. Download the Asianet News Official App from the Android Play Store and iPhone App Store for accurate and timely news updates anytime, anywhere.