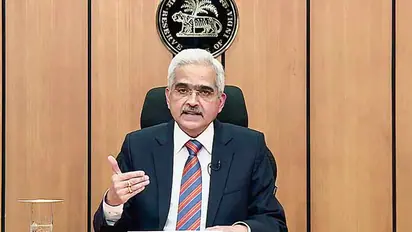

Is Rs 5000 note launching in India? RBI clarifies rumors

Published : Jan 01, 2025, 12:24 PM IST

Social media is abuzz with discussions about the introduction of a 5000 rupee note. The RBI has clarified the situation, providing essential information for the public.

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.