The sharp decline erased half of the company’s market capitalization within hours of the U.S. market opening, making it the top trending ticker on Stocktwits.

Wolfspeed (WOLF) shares lost nearly half their market capitalization on Friday morning, reaching a record low of $2.83, as speculation mounted that the company had lost access to CHIPs Act funding and could face bankruptcy.

The sharp decline came within hours of the U.S. market opening, pushing it to the top of the trending tickers list on Stocktwits.

The company has responded to the rumours, stating that it "continues to explore alternatives with regard to its convertible notes, in partnership with its advisors, and remains in a dialogue with lenders, including Apollo and Renesas."

"The Company also maintains constructive dialogue with the White House, its legislators, and the U.S. Department of Commerce to secure federal funding and on ways Wolfspeed can support the Trump Administration's efforts to reinforce U.S. industrial leadership in semiconductors, secure domestic supply chains, and reshore the manufacturing of critical mineral derivatives, including semiconductor wafers," it said reaffirming its third quarter (Q3) revenue guidance of between $170 million to $200 million.

The sell-off comes on the heels of Wolfspeed's appointment of Robert Feurle as its incoming CEO on Thursday, replacing Executive Chair Thomas Werner on May 1.

Concerns over Wolfspeed’s access to CHIPs Act grants surfaced in January when reports suggested some funding allocations were in "limbo" due to the Trump administration's efforts to curb federal spending.

Wolfspeed had sought up to $750 million in direct funding from the U.S. Department of Commerce under the CHIPS and Science Act.

The funding was intended to support the company’s silicon carbide manufacturing expansion in North Carolina and New York – key projects for advancing clean energy technologies and electric vehicles.

During the company’s second-quarter (Q2) earnings call, Werner emphasized Wolfspeed’s strategy to secure CHIPs funding and strengthen its financial position.

“We have already made significant progress on these initiatives, evidenced by our completion of our $200 million at-the-market equity offering, which puts us one step closer to finalizing our CHIPS funding,” Werner said.

However, multiple Wall Street firms lowered their price targets on Wolfspeed following its mixed Q2 earnings report and guidance.

Earlier this month, the company announced job cuts in an effort to achieve positive free cash flow more quickly.

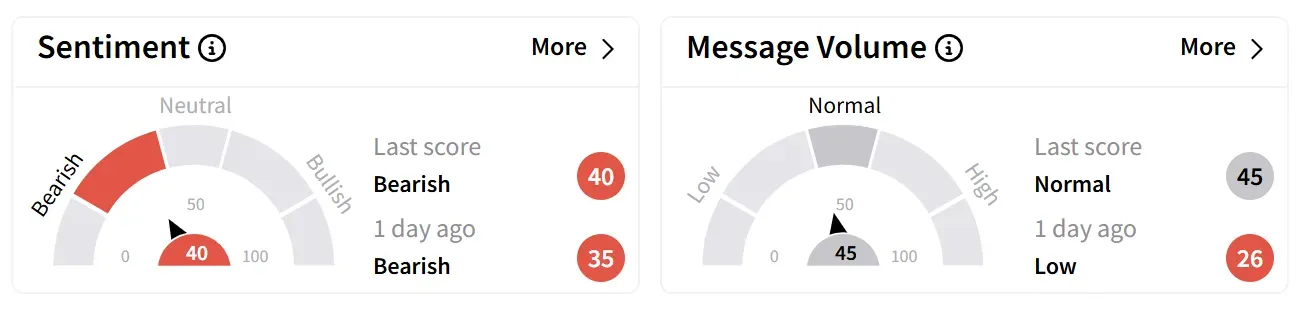

On Stocktwits, retail sentiment around Wolfspeed’s stock improved but remained in ‘bearish’ territory as chatter increased.

Users debated whether the stock’s sharp decline was tied to the potential loss of CHIPs funding or fears of bankruptcy.

One user speculated that Wolfspeed’s stock might find support around $2 but questioned who would be willing to buy, given the uncertainty surrounding bankruptcy rumors.

Wolfspeed shares have lost nearly all their value over the past year, falling more than 90%. The stock is down nearly 60% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: Gold Stocks Gain As Precious Metal Hits Record High – But Retail Sentiment Weakens

Editor's Note: This story has been updated with Wolfspeed's statement.<