The unfolding week will witness the release of twin inflation readings, the retail sales report for January, and a deluge of speeches by Federal Reserve officials.

The unfolding week promises a lot of action on Wall Street, with President Donald Trump hinting at a 25% import tax on all steel and aluminum entering the U.S. and the imminent release of some key market-moving economic data.

The week will witness the release of twin inflation readings, the retail sales report for January, and a deluge of speeches by Federal Reserve officials.

Futures trading point to a higher opening by U.S. stocks on Monday.

Against the backdrop, some technology and communications stocks saw a strong increase in message volumes on Stocktwits at the start of the week. These include:

Palantir Technologies, Inc. (PLTR)

Shares of Denver, Colorado-based Palantir have been on a tear since the data analytics company’s fourth-quarter print. In premarket trading, Palantir stock traded up nearly 1%.

On Friday, the stock hit an intraday high of $116.30 and closed slightly off its all-time closing high of $110.85. Since the start of the year, it has added nearly 47%.

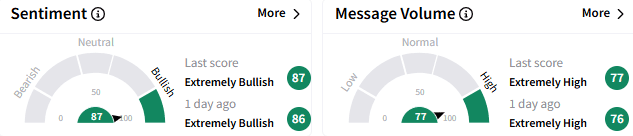

The retail users of the Stocktwits platform are ‘extremely bullish’ (77/100) on the stock and the message volume is also ‘extremely high.’

A section of the stock watchers are already eyeing the “120+” levels.

The 24-hour change in message volume for the stock is 4,563%.

Super Micro Computer, Inc. (SMCI)

Artificial intelligence server manufacturer Super Micro has a key catalyst ahead as the company gears up to issue its fiscal year 2025 second-quarter business update.

Since the update was scheduled, the stock has gained some upward momentum. It has added 19% for the year-to-date period.

On average, analysts expect Super Micro to report earnings per share of $0.63 and revenue of $5.78 billion for the quarter. This compares to the year-ago numbers of $0.56 and $3.66 billion.

On Stocktwits, retail sentiment toward Super Micro stock stayed ‘extremely bullish’ (87/100), with message volume at ‘extremely high’ levels.

A user said the stock setup is good and it could run past the $50 level.

https://stocktwits.com/_Bullishbull/message/603541918

An ongoing Stocktwits poll that has collected responses from 7,600 users so far showed that 78% braced for a 10% or more gain for the Super Micro stock following the update.

The message volume on the Super Micro stream has increased by 2,167% over the past 24 hours.

Trump Media & Technology Group Corp. (DJT)

Trump Media & Technology Group (TMTG) stream on Stocktwits has been seeing frenzied activity as retailers chat about the president’s policies and moves.

The 24-hour message volume change was 1,821%.

Retail sentiment toward TMTG stock remained ‘bearish’ (31/100), with the message volume staying at ‘normal’ levels.’

TMTG owns the Truth Social platform, which has failed to find any traction as legacy social media companies dominate with strong user metrics. The company recently announced plans to offer Bitcoin (BTC.X) exchange-traded funds and other thematic financial products.

Blue Hat Interactive Entertainment Technology (BHAT)

Xiamen, China-based Blue Hat Interactive Entertainment, which previously produced augmented reality (AR) interactive entertainment games, toys, educational materials, etc, has since then pivoted to commodity trading, primarily ethanol, and diamonds and gold jewelry.

Blue Hat Interactive stock has lost over 60% so far this year.

In premarket trading, the nano-cap, penny stock climbed over 17%. On Stocktwits, retail investors have been mostly positive on Blue Hat Interactive stock. Gold’s strength early Monday should also provide a shot in the arm for the stock.

Reflecting the brisk messaging, the message volume has risen over 1,334% over the past 24 hours.

MicroCloud Hologram, Inc. (HOLO)

MicroCloud Hologram, based in Shenzhen, China, provides holographic technology services, including holographic light detection and ranging (LiDAR) solutions and holographic digital twin technology services.

The nano-cap's stock received a boost in late December when it announced its foray into quantum computing. Its announcement regarding the usage of the DeepSeek model as the basis for its holographic AI application lent further momentum to the stock in late January.

Since the start of the year, MicroCloud Hologram stock has lost about 72%. The MicroCloud Hologram stream on Stocktwits saw a 1,275% spike in message volume over the past 24 hours.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<