The company said the reduced losses were primarily due to decreased operating expenses.

Shares of PDS Biotechnology Corporation (PDSB) drew investor attention on Thursday after the company reported better-than-feared losses for 2024.

PDS Biotechnology reported a loss per share of $1.03 for the year, narrower than the $1.39 reported for 2023 and better than an analyst estimate of $1.11, according to FinChat data.

Net loss narrowed to $37.61 million in 2024 compared to $42.94 million in the prior year.

The reduced losses, the company said, were primarily due to a decrease in operating expenses.

Research and development expenses fell during the year to $22.6 million from $27.8 million a year ago, owing to reduced clinical costs, personnel costs, and professional fees.

The company ended the year with a cash balance of $41.7 million.

Last month, PDS Biotechnology announced an up to $22 million registered direct offering. The company said the securities purchase agreements with new and existing healthcare-focused institutional investors included $11 million of upfront gross proceeds.

It also included up to an additional $11 million of aggregate gross proceeds upon cash exercise in full of warrants issued to the investors.

PDS is a late-stage immunotherapy company developing investigational products designed to stimulate and enhance targeted T cell responses against cancers.

Earlier this month, the company said that the U.S. Food and Drug Administration has cleared its Investigational New Drug (IND) application to evaluate a combination of its investigational immunotherapy candidate Versamune MUC1 with a novel investigational tumor-targeting Interleukin 12 to treat colorectal carcinoma in certain patients who failed previous treatment.

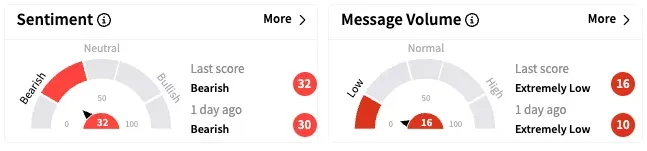

On Stocktwits, the retail investor sentiment about PDS Biotechnology dropped further into the ‘bearish’ territory (32/100), while message volume remained at the ‘extremely low’ level over the past 24 hours.

After the company released its earnings report, HC Wainwright analyst Joseph Pantginis lowered the firm’s price target to $13 from $21 while keeping a ‘Buy’ rating on the shares.

A Stocktwits user, however, expressed optimism on the company.

Another user opined that the results were “not as bad as predicted.”

PDSB shares have lost over 25% this year and over 65% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<