Morgan Stanley’s Meta Marshall said she is comfortable stepping into Hewlett-Packard Enterprises stock as she believes there is little downside to near-term numbers.

Hewlett-Packard Enterprise Co. ($HPE) stock received an upgrade from Morgan Stanley ahead of the company’s fiscal year 2024 fourth-quarter results due Thursday after the market close.

The shares of the company were last seen trading up 1.38% at $22.06 after advancing nearly 31% for the year.

Q4 Expectations

Analysts, on average, expect Hewlett-Packard Enterprises to report fourth-quarter non-GAAP earnings per share (EPS) of $0.56 and revenue of $8.25 billion. The guidance issued in late July modeled non-GAAP EPS between $0.52 and $0.57 and revenue between $8.1 billion and $8.4 billion.

The company expects non-GAAP EPS of $1.92-$1.97 for the full year and revenue growth of 1%-3% in constant currency.

An earnings call with the management is scheduled for 5 p.m. ET.

Morgan Stanley analyst Meta Marshall said there is little risk to Hewlett-Packard Enterprises’ fourth-quarter print, as earnings from Cisco Systems and Dell Technologies suggest a fairly healthy enterprise spending environment.

The analyst expects sequentially flat artificial intelligence server revenue.

In the third quarter, servers contributed about 56% of total revenue, while intelligent edge, hybrid cloud and financial services made up about 14%, 17% and 11%, respectively.

Morgan Stanley Upgrades

Morgan Stanley’s Marshall upgraded Hewlett-Packard Enterprises’ stock from ‘Equal-Weight’ to ‘Overweight,’ and increased the price target from $23 to $28. The analyst clarified that the upgrade was not related to the fourth-quarter print.

Marshall sees a 40-50% upside to pro forma earnings power, driven by networking, given the Juniper Networks, Inc. ($JNPR) deal is likely to close soon. This can help the stock rerate to a more blended hardware-networking multiple of 12 times as opposed to its traditional 8 times multiple.

“Combined with Juniper coming out of an inventory digestion and having new cloud customers, we are biased to think that there is more upside to Juniper's numbers in the near term vs. downside upon the combination,” she said.

“We feel comfortable stepping into HPE,” the analyst said, adding that checks/competitors point to little downside to the company’s numbers in the near term.

Marshall expects Hewlett-Packard’s EPS guidance to be below the Street estimate due to higher debt for Juniper.

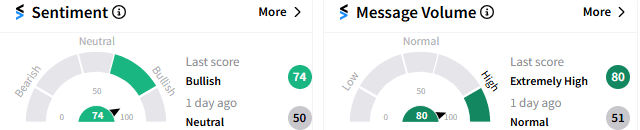

Sentiment toward Hewlett-Packard stock turned ‘bullish’ (74/100) on Stocktwits, an improvement from the ‘neutral’ mood that prevailed a day ago. Message volume also improved to ‘extremely high.’

For updates and corrections email newsroom[at]stocktwits[dot]com.<