The stock dropped 5% to a nearly four-year low, even as retail sentiment inched higher.

General Mills (GIS) shares fell 5% to a nearly four-year low on Wednesday, after the packaged food company forecast fiscal 2026 profit below analysts' expectations, blaming market conditions.

The company expects full-year adjusted profit to decline between 10% and 15%, compared to analysts’ estimates of a 4.8% decline from LSEG/Reuters. It expects organic sales to be down 1% to up 1% versus the 2% decrease in the last fiscal year ended May 2025.

"We expect the operating environment will remain volatile, with consumers pressured by widespread uncertainty from tariffs, global conflicts, and changing regulations," CEO Jeff Harmening said.

"Amid this uncertainty, we expect consumers to remain cautious and continue seeking value."

General Mills' fourth-quarter results also failed to impress. Net sales decreased 3% to $4.56 billion, narrowly missing expectations of $4.59 billion. Adjusted profit fell 46% to $0.53 per share.

The company said growing organic sales is its top priority for this year. It also expects to achieve $100 million in incremental cost savings from its ongoing restructuring efforts in the current fiscal year.

In recent quarters, the company has expanded its product line, particularly in the pet food category, and adjusted prices and product mix in response to market conditions.

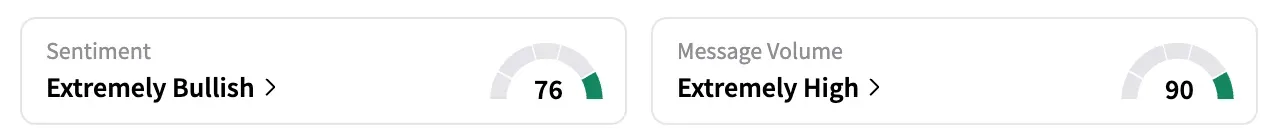

On Stocktwits, the retail sentiment for General Mills shifted to 'extremely bullish' as of early Thursday from 'bullish' the previous day.

GIS shares are down 20.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<