Coca-Cola Consolidated buys syrups from Coca-Cola and produces, packages, distributes, and sells the finished beverages in the U.S.

Coca-Cola Consolidated (COKE), one of the bottlers of Coca-Cola (KO) in the United States, is splitting its common and class B shares 10-for-1.

Stock splits are typically done to lower the per-share value to make shares more affordable to a broader range of investors.

Coca-Cola Consolidated said its board and shareholders have approved the split.

The additional shares will be allotted to shareholders on May 23, and the stock will begin trading on a split-adjusted basis on May 27.

Coca-Cola Consolidated shares have strengthened in recent years. The stock has more than doubled since the start of 2023.

The company last split its shares in 1998. Coca-Cola, the larger firm, split its shares 2-for-1 in 2012.

Coca-Cola is the global beverage giant, which owns trademarks, formulas, and brands such as Coca-Cola, Sprite, Fanta.

Coca-Cola Consolidated buys syrup from Coca-Cola and produces, packages, distributes, and sells the finished beverages primarily in the southeastern U.S. and parts of the Midwest.

Even amid uneven demand, Coca-Cola beat estimates for revenue and profit last quarter and maintained its full-year forecasts, thanks to price hikes in its products.

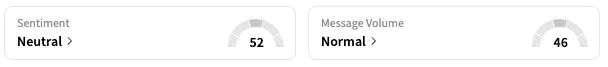

On Stocktwits, the retail sentiment was 'bullish' for Coca-Cola Consolidated, and 'neutral' for Coca-Cola.

The two businesses are naturally interconnected, but their stock movements often diverge.

COKE shares are down 6.7% year to date, while KO shares are up 15.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<