Scotiabank said the underperformance “presents an opportunity to buy a high-quality company at an attractive price."

Canadian Natural Resources (CNQ) U.S. shares rose 2.4% on Wednesday after Scotiabank upgraded the Toronto-listed shares of the company to ‘outperform’ from ‘sector perform.’

According to TheFly, the brokerage noted that the stock has underperformed its Canadian and international large-cap peers over the past year due to its tariff exposure and weaker oil prices.

Canada exports about 4 million barrels per day of oil to the U.S., which amounts to about 90% of the country’s total exports. Canadian Natural is the top oil producer from he U.S.'s northern neighbor.

Scotiabank said this underperformance “presents an opportunity to buy a high-quality company at an attractive price."

The research firm added that the underperformance was overdone and that the fundamentals remain strong.

Canadian Natural will "disproportionately benefit" when the tariff dispute is resolved and or oil prices move higher, Scotiabank noted as per TheFly.

Earlier this month, the company posted a record quarterly production of 1.47 million barrels of oil equivalent per day (boe/d) compared with 1.42 million boe/d a year earlier, aided by robust oil sands production.

The Calgary, Alberta-based company has completed several acquisitions over the past few months to boost its production.

In December, Canadian Natural closed its deal to acquire Chevron’s Alberta assets for $6.5 billion. Earlier this year, the company swapped Shell’s remaining 10% working interest in the Albian mines for a 10% working interest in the Scotford Upgrader and Quest Carbon Capture and Storage facilities.

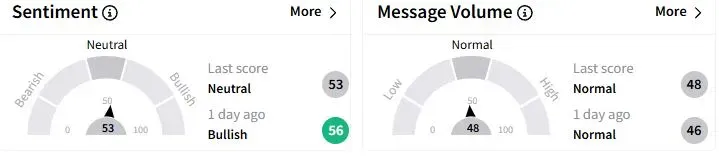

Retail sentiment on Stocktwits moved to ‘neutral’ (53/100) territory from ‘bullish’(56/100) a day ago, while retail chatter was ‘normal.'

One bullish user asked the community if the stock was the best in the energy sector.

Canadian Natural shares have fallen 1.5% year-to-date (YTD).

Oil prices gained on Wednesday after a larger-than-expected drawdown of U.S. distillate inventories, according to a Reuters report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<